Comprehensive protection for your bach or your holiday home, with flexible cover if you also rent to guests.

What does Holiday Home insurance cover?

Full House Replacement

Rebuild or repair your house and other structures up to your replacement value

Guest Cover

Optional cover for damage, theft and loss of rent if you host guests

Contents Cover

$20,000 standard cover for fixed contents at the home, with options to increase

More excellent benefits

-

Hidden Gradual Damage

$3,000 for gradual water damage from a hidden water or waste pipe.

-

Excess-free Keys & Locks

$1,000 of cover for replacing keys and associated locks, with no excess.

-

Excess-free Blocked Pipe

Up to $1,000 to unblock an underground pipe, with no excess.

-

Legal Liability

$2 million legal liability costs if an accident damages other property, or people.

![]()

Also rent your family holiday home on Airbnb, or to guests?

Don’t worry, we’ve designed our cover for this so we won’t invalidate your policy.

- Cover for damage, and theft by guests

- No nasty hidden, or additional excesses

- Loss of rent cover if your house is unliveable and can’t be rented to guests

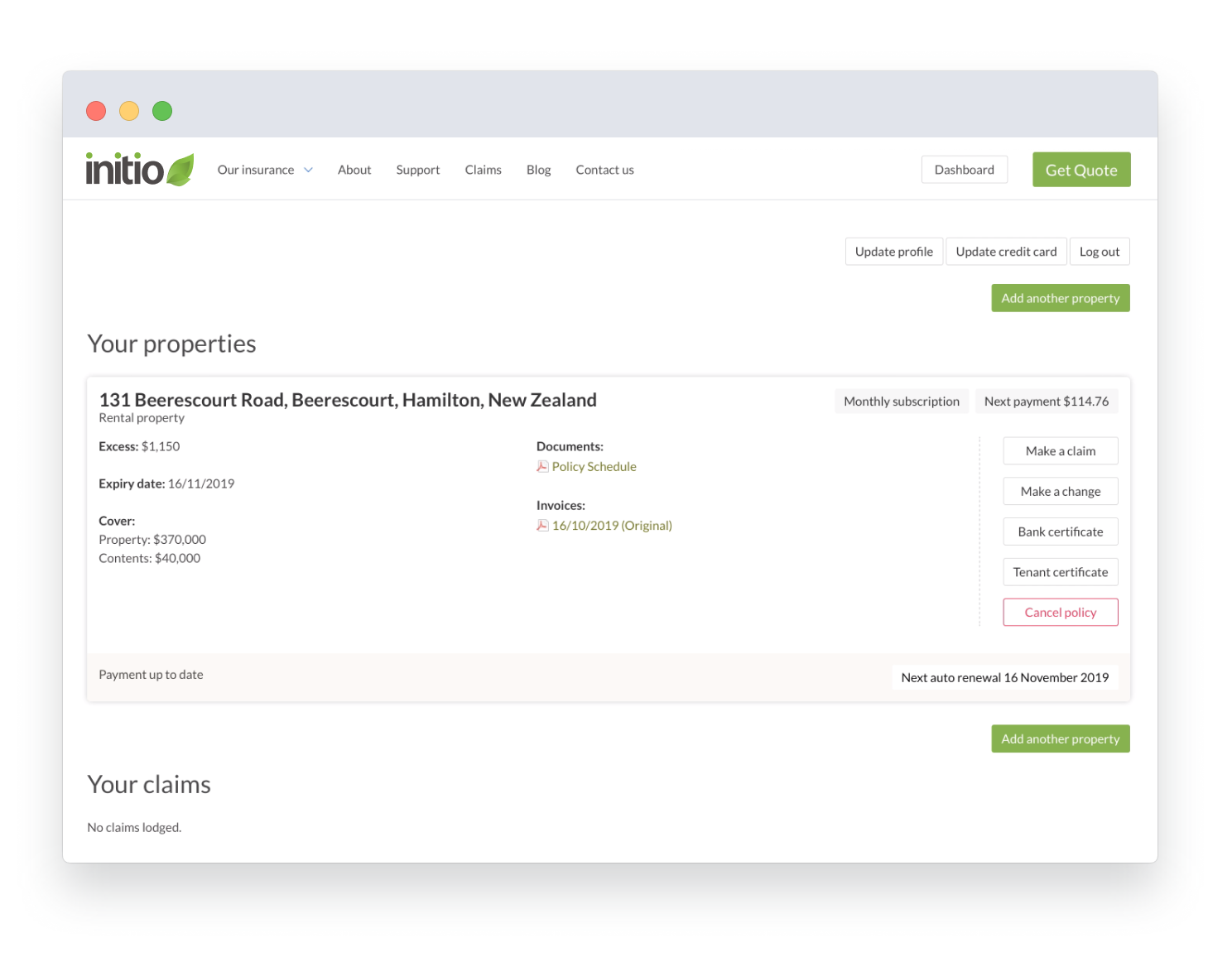

You're in control with the initio dashboard

-

Manage your insurance online

Every customer gets access to their own personalised dashboard login.

-

No more lengthy phone calls

Change your policy, lodge claims, add and cancel policies or get documents all online from your smart device or computer.

Common questions about holiday home insurance

First, make sure your new initio policy is in place. We let you place cover any day up to a month in advance.

You’ll then need to contact your insurance company and tell them to cancel your policy from the same date.

If you indicate that you also rent your family holiday home to guests (for short term lets) we provide cover for accidental damage, malicious damage, meth manufacturing caused by your guests.

If your house is badly damaged and you can’t rent it to guests, we’ll cover lost rent based on an estimate of what your bookings would have been while the house is repaired.

It’s worth noting that if you are handing your property over to a holiday home management company under a full management contract, where they effectively have control over your property, then for the purposes of insurance it is not considered your holiday home and we will not be able to provide cover. This is because with a full management contract you lose your entitlement to occupy the property whenever you wish, which means that there is no cover provided by the Natural Hazards Commission (NHC). We cannot provide cover if the NHC is not providing cover. Learn more here

To qualify as a holiday home (for insurance purposes), the owner must;

- demonstrate use of the property, and;

- Have the right to occupy the property at will, and;

- Store personal belongings at the home.

If you are handing your property over to a holiday home management company under a full management contract, where they effectively have control over your property, then for the purposes of insurance it is not considered your holiday home and we will not be able to provide cover. This is because with a full management contract you lose your entitlement to occupy the property whenever you wish, which means that there is no cover provided by the Natural Hazards Commission (NHC). We cannot provide cover if the NHC is not providing cover. Learn more here

Under our cover you must demonstrate that this is your family holiday home and use the house at least occasionally yourself over the course of a typical year.

If you don’t use the house yourself, and it is only rented to short-term guests it is considered a commercial operation, similar to a motel.

Our cover is domestic based house insurance, so you’ll need to use the property for your personal use.

Your personal contents items, like phones, Jewellery and Laptops won’t be covered under your holiday home cover as they should be protected by your contents cover at your main home.

Belongings that remain at your holiday home like furniture, TV’s and glassware are covered.

You’ll need to choose a sum insured that’s enough to fully demolish and rebuild your house to its existing size (at today’s building costs).

If you’re unsure what the rebuild costs would be, we recommend you use the Cordell Sum Sure Calculator to help you get an estimate.

See here for a full guide on choosing your sum insured.

Yes, initio holiday home insurance includes cover for natural disasters such as earthquakes, floods, and landslides, up to the sum insured on your policy.

From 1 July 2024, the Natural Hazards Insurance Act 2023 applies. Under this, the Natural Hazards Commission (NHC) covers the first $345,000 (including GST) of qualifying natural disaster damage. Initio then provides top-up cover for any additional repair or rebuild costs, up to your selected sum insured.

Flood damage to your home is also automatically covered by initio, with no contribution from the NHC required for the home itself.

For more details, you can visit the Initio page on what we cover for natural disaster cover and our summary of the NHC’s cover here.