Cover for the house itself, and the risks of renting to tenants.

Get a quote in seconds and cover online in minutes with New Zealand’s easiest landlord insurance.

What does our Landlord Insurance cover?

We include, by default, the things you need as a landlord

Loss of Rent

Up to 12 months or $20,000 following damage to your house

Deliberate Damage

Up to $25,000 for damage or theft by your tenants

Meth Contamination

$30,000 of cleaning cover, and additional loss of rent

Landlord Contents

$20,000 of standard cover, with options to increase

More of our excellent benefits

-

Replacement Cover

Full rebuild cover for the house, up to your replacement sum insured.

-

Legal Liability

$2 million legal liability costs if an accident damages other property, or people.

-

Excess-free Blocked Pipe

Up to $1,000 to unblock underground pipe, with no excess.

-

Hidden Gradual Damage

$3,000 for gradual water damage from a hidden water or waste pipe.

-

Excess free Keys & Locks

$1,000 of cover for replacing keys and associated locks, with no excess.

-

Loss of Rent - Tenant Eviction or Vacation

Six weeks of cover if tenant’s are evicted for non-payment, or abandon tenancy.

Useful Tools

Compare our Cover

Want to see how our cover stacks up against other landlord insurance providers?

House Rebuild Calculator

Not sure what it would cost to fully rebuild your rental if it was completely destroyed?

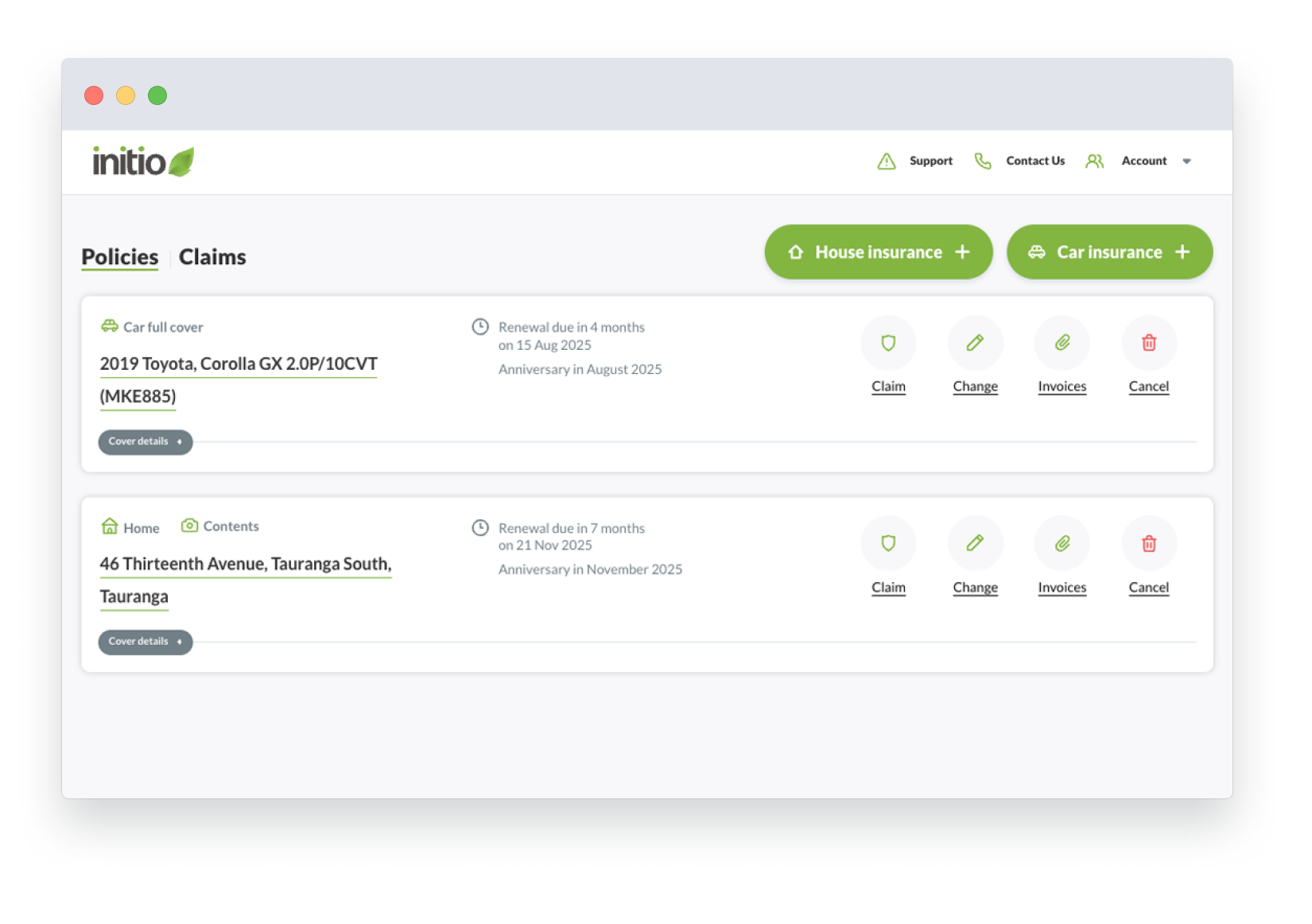

You're in control with the Initio Dashboard

-

Manage your insurance entirely online

Every customer gets access to their own personalised dashboard login.

-

Need an insurance statement/tenant certificate for your new or renewing lease?

Download at anytime directly from your initio dashboard.

-

No more waiting on the phone!

You can make changes to your policy, lodge claims, add and cancel policies or get documents all online on your smart device or computer.

New Zealand's Landlord Insurance Specialists

-

Used by the Best

Insurance partner of the New Zealand Property Investors Federation. We insure New Zealand’s leading landlords.

-

Designed for Landlords

Policy made specifically for landlords. We understand the cover you need, with a quick and easy platform for managing your insurance online.

This is not an exhaustive list and it doesn't imply all loss types described are covered or not. Claims are like butterflies, each unique with its own facts that we need to apply to our policy.

Why initio?

We use technology to save you time and money

100% Online

Instant online quotes in seconds, with the same approach to claims.

Support Focused

We're here to support you, not sell. Let us show you the way to better insurance.

Great Cover

We don't expect you to build your own policy. We include the things that matter, bells & whistles too.

You’re in safe hands

If disaster strikes, you’re in good hands. Initio policies are underwritten by IAG New Zealand Ltd. Standard & Poor’s has given IAG a AA ‘Very Strong’ Financial Strength Rating.

Learn more about our financial strength rating

Common questions about landlord insurance

Standard house insurance is for homes you live in yourself, while landlord insurance is designed for properties rented to tenants.

Initio’s landlord insurance includes cover for rental-specific risks like tenant damage, meth contamination, loss of rent (due to damage or tenant default), and landlord contents. These are not typically included in a standard house insurance policy.

Learn more about landlord insurance.

Yes – our landlord insurance includes loss of rent protection in these situations:

Your rental becomes uninhabitable due to sudden, accidental damage covered by the policy (like fire or flooding)

Your tenant stops paying rent, abandons the property, or is legally evicted

We’ll pay up to 12 months’ rent, capped at your selected loss of rent limit.

With initio, you can arrange landlord insurance in less than 5 minutes:

-

Enter the address of the property you want to insure

-

Answer a few quick questions

-

Select the cover that suits you

-

Choose your payment option (monthly or annual)

-

Make your payment

Your policy documents are sent straight to your email and are also available anytime in your initio dashboard– 24/7.

Start by getting your instant landlord insurance quote.

The contents section of initio’s landlord insurance covers items that you own which are provided for tenants’ use. This includes:

- Whiteware (e.g. fridge, washing machine)

- Furniture

- Curtains and blinds

- Loose floor coverings

It does not cover tenants’ belongings, your own personal effects or items you’ve left at the address in storage.

Learn more about landlord contents cover.

Understand the difference between contents cover options

Yes. Initio includes automatic protection for malicious damage and theft by tenants, up to $25,000 per event. This includes things like intentional wall damage or theft of your appliances. This protection is designed to help landlords manage the risks associated with renting out their property.

Changes to the Residential Tenancies Amendment Act 2019 mean you can only hold your tenant responsible in some circumstances (depending on whether the damage is accidental, careless or intentional). For an overview of who is responsible, read more here.

For full details on what’s included and excluded, check out our landlord insurance policy wording.

Yes. With initio’s landlord insurance, an excess applies per event of damage. If the tenant damage is made up of multiple unrelated events, then multiple excesses can apply.

For example, if you discover different types of unreported damage – such as holes in walls and carpet stains – after the tenant vacates, and they appear to be from unrelated events, each incident could attract its own excess.

However, if the damage is clearly from a single event (like an out-of-control party), then only one excess may apply. Generally, initio applies one excess per room or per item of damage, rather than for every individual scuff or mark, but each claim is assessed individually.

Read our guide on excesses for tenant damage claims to learn more.

You should insure your rental for the full replacement cost – that means

- Building materials and labour to rebuild to existing size and quality

- Demolition and debris removal

- Council and professional fees (eg architects, engineers, permitting)

- GST

- Inflation buffer

- Permanent structures and outdoor features, such as garages, retaining walls, patios, fences, sheds, swimming pools and pergolas.

Let us know if you have any recreational features such as swimming pools over the policy limit of $45,000 or retaining walls collectively over the policy limit of $25,000.

If you’re unsure about the rebuild costs, we recommend using the Cordell SumSure Calculator to help estimate an appropriate sum insured. Learn more about choosing your sum insured.

Yes. Your initio dashboard lets you:

- Update cover limits

- Add or remove landlord contents cover

- Change your excess

- Cancel or renew policies

- Download your documents anytime

You can also make a claim straight from your dashboard – no paperwork and no waiting on the phone. Simply upload your supporting documents and track updates as they happen.

You’re in full control of your landlord insurance 24/7. Log in to your dashboard

Our landlord product is designed for long term residential letting only. If you use your investment property for short term lets you will need a commercial insurance that we are unable to provide via initio.

Provided your tenant is using the cabin for residential purposes only and has taken reasonable steps to install and use it safely, there’s no issue with your insurance.

For example, we’d expect the electricity to be connected in a safe and approved way.

The tenant would be responsible for arranging their own insurance for the cabin itself.

Yes, initio landlord insurance includes cover for natural disasters such as earthquakes, floods, and landslides, up to the sum insured on your policy.

From 1 July 2024, the Natural Hazards Insurance Act 2023 applies. Under this, the Natural Hazards Commission (NHC) covers the first $345,000 (including GST) of qualifying natural disaster damage. Initio then provides top-up cover for any additional repair or rebuild costs, up to your selected sum insured.

Flood damage to your home is also automatically covered by initio, with no contribution from the NHC required for the home itself.

For more details, you can visit the Initio page on what we cover for natural disaster cover and our summary of the NHC’s cover here.