Pro-tips for property owners. Tip #1: initio has you covered

Welcome to our newest blog series, where we delve into the essentials of readiness and resilience, covering everything from crafting a solid emergency plan to ensuring your sum insured is spot-on, and streamlining your insurance for the holiday season and beyond. However, before we explore these topics, we’re turning the spotlight on ourselves. While we remain hopeful for a calmer year ahead, we wouldn’t be in the insurance game if we didn’t value cautious optimism and thorough preparation for unforeseen events.

Join us as we kick off this series by demonstrating our commitment to continuous improvement and meticulous preparation, paving the way for a discussion on how you can do the same. It’s the first step in a series dedicated to empowering you with the knowledge and tools to protect what matters most.

We’ve got our house in order

Behind the scenes, we’ve been busy beefing up our infrastructure and services. Why, you ask? Because we want to be rock-solid for our customers when they need it. It’s all about making sure we’re ready with a helping hand, especially in those critical moments. By bringing in some of the coolest tech and smoothing out our processes, we’re not just hitting the mark; we’re aiming to soar way past it. Our mission? Building a stronger, niftier initio that’s ready to tackle whatever twists and turns come our way, giving our customers that awesome feeling of being in good hands. So, how exactly have we been doing this? Let’s dive in:

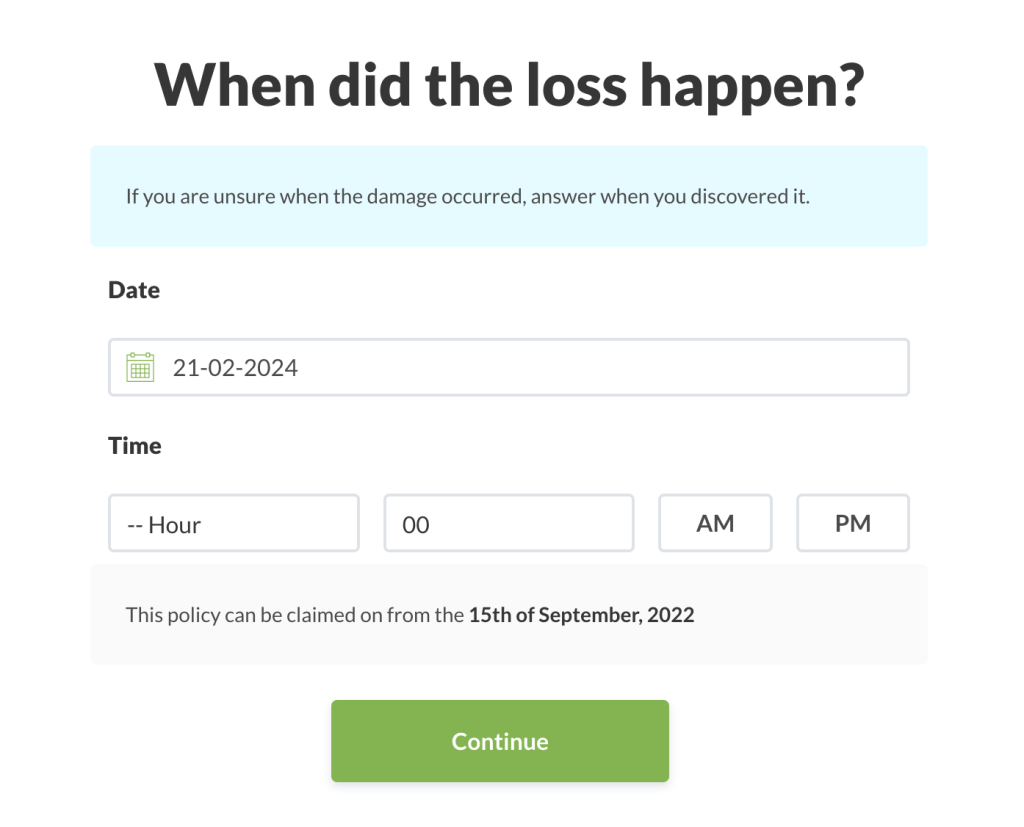

- Smart Claims upgrade: We’ve upgraded our smart claims system for quicker, more efficient processing. This ensures easier claims lodging and faster assistance in a crisis.

- More team members: We want to make sure we’re always ready to help. So, we’ve brought more people into our team. This means when things get tough, you’ve got more friends at initio to support you when you need it most.

- Location adjustments: We now use more detailed data in our location-based risk assessments. This helps us offer advice and solutions tailored to the unique risks of different New Zealand regions.

- Website upgrades: Our development team recently completed a 4-month platform refresh project to help us go faster and make your insurance even more seamless.

- Continuous learning: Following the 2023 events, we’ve refined our policies and practices to stay ahead in disaster preparedness.

No system can be entirely foolproof against the forces of nature. However, by taking these steps, we aim to enhance our resilience and readiness, providing our customers with the assurance that we’re better prepared to support them through any future challenges. Remember, being prepared is not just about having insurance; it’s about having the right support when you need it most.

The choices you make now can significantly impact your peace of mind and financial security in the future. Our team are always ready to assist you in making informed decisions about your insurance. Feel free to reach out with any questions, or visit our website for more information and resources.

Visit our FAQ pages for more insights and updates on how to manage your insurance effectively. Our goal at initio remains to make insurance easy.