Residential Tenancies Amendment Act – who now pays for damage?

On 30th of July 2019 changes to the legislation around tenant damage and meth contamination were passed into law.

The Residential Tenancies Amendment Act 2019 will:

- limit tenants’ liability for careless damage in rental properties to the landlord’s insurance policy excess or 4 weeks rent (whichever is less)

- re-open the ability for the landlord to recover against the tenant for damage, albeit on a very limited basis

- allow tenants to share in and receive protection from the landlord’s insurance policy

- mean that landlords must provide confirmation of insurance cover to all new tenancies and their exisiting tenants on request

- prevent insurers from pursuing tenants for unintentional damage (ie careless or accidental damage)

- allow for regulations to be made to address how contamination (eg. meth) of rental properties is tested and managed

- give the Tenancy Tribunal full jurisdiction over cases concerning premises that are unlawful for residential purposes, such as garages and sleep-outs, which don’t meet minimum requirements for renting

- protect tenants living in those unlawful premises, as the Residential Tenancies Act will now apply

- give Tenancy Services the ability to take enforcement action against landlords who rent properties which don’t meet minimum standards

These changes are scheduled to take effect on 27 August 2019. The provisions of this new Act only apply to damage occurring after this date.

So, I’m a landlord, how do these changes affect me and my insurance?

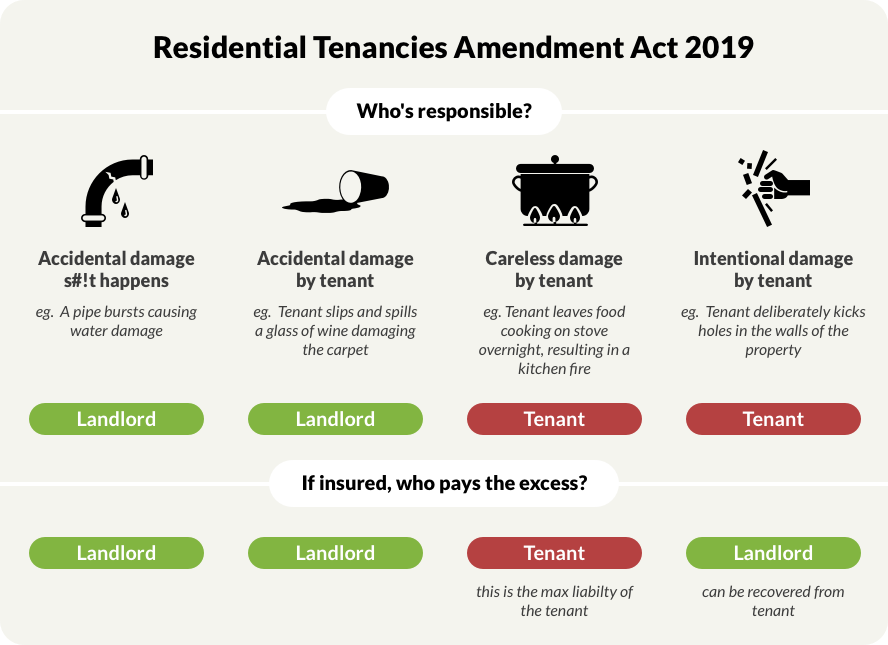

It depends on how the damage has been caused. There are four ways a rental property can suffer damage:

Accidental Damage – S#!t Happens eg. storm damage

Accidental damage is damage that can’t be avoided, because sometimes s#!t happens. This could be caused by an ‘act of god’ type loss such as a storm causing damage to the roof of the property. Or it could be a leaking water pipe or an electrical fire. This type of damage is completely outside of the control of the tenant liability, and as such they have no liability for this damage. The landlord is responsible for this damage, and will usually have insurance to pay the claim.

- Who is responsible for the cost of the damage? answer: the landlord (ie. their insurer)

- Who pays the insurance excess? answer: the landlord

Accidental Damage by Tenant eg. spilling a glass of red wine on the carpet

Accidental damage can also be caused by a third party, such as a tenant. This could come in the form of a tenant tripping and spilling wine on the carpet, or their washing machine flooding. In both cases these are technically outside of the control of the tenant and there is no liability on the part of the tenant. So even if the tenant causes the accidental damage, the tenant has NO liability. The tenant can rely on the landlord’s insurance policy the repair the damage, and the tenant cannot be made to pay the insurance excess (or 4 weeks rent).

- Who is responsible for the cost of the damage? answer: the landlord (ie. their insurer)

- Who pays the insurance excess? answer: the landlord

Careless Damage by Tenant – eg. leaving a pot cooking on the stove and going to bed

Where a tenant (or their guest) carelessly causes property damage to the home, they are liable for those damages. This could be where the tenant leaves a pot cooking after going to bed and causes fire damage to the kitchen. While the amendment to the act now makes the tenant liable, the maximum amount the tenant can be held responsible for is the landlord insurance policy excess, or 4 weeks rent (whichever is lesser). The new Act effectively allows the tenant to share in and receive the benefit of the insurance arranged by the landlord.

- Who is responsible for the cost of the damage? answer: the tenant (but its capped at the lessor of the landlords insurance excess or 4 weeks rents)

- Who pays the insurance excess? answer: the tenant (see pain points below)

Intentional damage by Tenant – eg. smashing holes in the wall

A tenant is not excused from liability when the damage is intentional or where the damage they (or their guest) have caused constitutes an imprisonable offence. In such circumstances the responsibility is on the tenant to notify the landlord of the damage. The landlord can request that the tenant repair the damage, but if the landlord is properly insured (ie has an initio landlord insurance policy) they will be covered for intentional damage so its best to lodge a claim for the damage, and allow the insurer to pursue the tenant for the cost of repairs.

- Who is responsible for the cost of the damage? answer: the tenant

- Who pays the insurance excess? answer: the landlord (but the insurer will attempt to recover the value of the excess from the tenant along with the costs the incurred to repair the damage)

What about Methamphetamine Contamination?

The Act allows landlords the right to enter the rental property (after providing notice to the tenant) to sample and test for meth contamination. If testing confirms that the property is contaminated to unsafe levels (currently higher than 1.5 μg per100 cm2) then the landlord, and the tenant, have rights to terminate the tenancy. The landlord can terminate with a minimum notice period of 7 days, whereas the tenant can terminate with only 2 days notice.

Meth testing must be done in accordance with the Standards New Zealand standard, and the landlord must notify the tenant within 7 days of receiving the test results.

If a landlord knowingly rents a property with meth contamination, the tenant can be awarded damages of up to $4,000.

We are still awaiting further details around this and exactly what standard will be set by the Housing Minister. Currently the NZ Standard, which the insurance industry follows says that a property is contaminated if the presence of meth exceeds 1.5 μg/100 cm2, however the Gluckman Report, which the tenancy tribunal follows says that a property is contaminated if it is more than 15 μg/100 cm2. We are expecting that the amendment to the Residential Tenancies Act will provide some consistency and that we will all move to 15 μg/100 cm2 as being the level where contamination occurs.

Given that the possession of meth can attract a penalty of up to 6 months imprisonment, and manufacture of meth a maximum penalty of life imprisonment, if use/possession or manufacture is proven at the property the tenant is NOT excused from liability and has NO protection from the landlords insurance policy. The landlord or their insurer can recover the cost of cleanup and repair from the tenant.

Who is responsible for the cost of the damage? answer: the tenant

Who pays the insurance excess? answer: the landlord (but the insurer will attempt to recover the value of the excess from the tenant along with the costs the insurer incurs to remediate the property)

Important: The likelihood of recovering costs from a tenant for meth damage is extremely low. Firstly proving it was the tenant is difficult, and secondly meth addicts generally don’t have the financial resources to pay for such large repairs.

Where are the pain points with these changes?

Accidental vs Careless

As accidental damage means that the landlord pays the excess, and careless damage means that the tenants pays the excess, we expect to see disagreements between landlords and tenants about the cause of the damage. If the landlord and tenant cannot agree whether the tenant is liable for the damage, the landlord can apply to the Tenancy Tribunal for the matter to be resolved. Copies of relevant insurance policies, photos of the damage, and receipts or quotes for repair should be included to support the application.

Is meth contamination careless or intentional?

We believe it is intentional but fortunately the new Act catches meth under the category of imprisonable offence. We anticipate that tenants (and maybe the courts) will continue to argue that the resulting damage from smoking meth is careless not intentional. Our opinion is that there is now enough information in the public domain for people to understand that meth causes property damage.

A tenant has carelessly damaged my property, I’ll leave the tenant to pay the excess to the insurer/repairer?

If you establish that the tenant has been careless this won’t mean that its a slam dunk on the tenant physically paying the excess.

We foresee there will be arguments over who physically pays the excess to the insurer or the repairer. Is it the insurer or is it landlord? Given that the policy owner is the landlord this suggests that the landlord would need to pay the excess and then recover it from their tenant. This may change in time as the new Act is tested with real loss scenarios.

We recommend that as soon as the landlord becomes aware of, and can establish that “careless damage” has occurred, that they hold their tenant responsible for the excess and request immediate payment.

What do I need to do?

You will need to provide a confirmation of insurance certificate to your tenant

Landlords are now required to provide all new tenants, and existing tenants where they request it, details of their property insurance. Any changes made to your insurance, also need to be notified to your tenants. Failure to do so could result in a $500 fine to be paid to the tenants. You can provide the tenant with a standard certificate of insurance but this will have more information on it than you are required to disclose (such as the Bank that has a mortgage over your property). Some insurers like initio have produced a specific Tenant Certificate. To obtain a Tenant Certificate of insurance to provide to your tenant or property manager you can get this through your initio dashboard.

Seeing the tenant is paying should I increase my excess?

Probably not – as the tenant only responsible for paying the excess some of the time.

A number of landlords have mis-interpreted that the tenant will pay the excess on all types of claims, and have moved to increase their insurance excess to align with approximately 4 weeks rent.

Remember that if you increase your excess, the higher excess will apply to ALL claims, not just the ones that the tenant is responsible for. The measure of tenant responsibility is carelessness so as a landlord you need to be able to establish that your tenant was careless in order to recover your excess from the tenant.

How do I increase my excess?

With initio you can easily do this by logging in to your dashboard and modifying your policy excess, and the credit premium adjustment will be refunded to you.

Established in 2010, Initio is a digital insurance provider specialising in property insurance, including rental property insurance, landlord insurance, holiday homes, and home and contents. Customers can quote, start cover, modify cover and make claims – all online. Initio is underwritten by NZI (IAG New Zealand Ltd)