What could go wrong at my rental?

A closer look at property damage for New Zealand Landlords

Rental properties, for all their promise of steady income and long-term value can, if not managed correctly, become ground zero for an array of unforeseen problems and potential hazards.

The reality is that damages, an often neglected aspect of rentals, pose a considerable risk to your investment. These risks are as varied as they are prevalent, raising a pertinent question in the minds of property owners: “What damage is most likely to occur at my rental property?”

Safeguarding your investments and mitigating potential losses, and understanding these risks is essential to success as a landlord.

A thorough examination of our 2022 loss data provides a detailed analysis of the challenges faced by New Zealand property owners. Last year, claims related to rented properties — including traditional rental properties, own homes partially rented, and properties with multiple rentals, made up 35% of all the claims we received. When focusing on these rental-specific claims, we identified a broad spectrum of loss types, which we’ve classified below in terms of number of claims:

Water-related damage: At 21.6%, this was the most common type of damage. These losses typically involved scenarios including suddenly bursting pipes and rodent damage, while blocked pipes accounted for 6.4%.

Accidental damage: This category, representing 18.1% of the claims, includes an array of unexpected incidents, from minor mishaps to substantial accidents, illustrating the diverse risks property owners encounter. The losses range from outdoor misadventures, such as balls shattering windows or trees falling onto the property (while being pruned), to indoor accidents like stains on carpets and damaged rugs, often due to spills or pet-related incidents. There were also multiple kitchen bench damage incidents – caused by hot pots.

Weather-related damage: Severe weather events substantially contributed to the claims we received, with flood-related incidents constituting 11.2% and wind-induced damage representing 9.9% of the total claims. These statistics do not include the severe flooding and storms experienced earlier this year. Weather damage events are hard for property owners to mitigate.

Other incidents: Some more specific types of damages also occurred, albeit less frequently. These included

- Malicious damage by tenants (4.6%),

- Fire – accidental or unknown reasons (1.1%),

- Meth contamination (1.5%),

- Issues with keys and locks (3.5%),

- Impact damage, typically involving a vehicle (5.5%) eg car versus house

Loss of rent: There were several circumstances that led to a loss of rental income, resulting in insurance claims. Property damage rendering the property uninhabitable was one such factor and is the most common.

However, issues such as tenant abandonment, non-payment of rent, and eviction also significantly contributed. These loss-of-rent-only situations accounted for 3.3% of the total claims made.

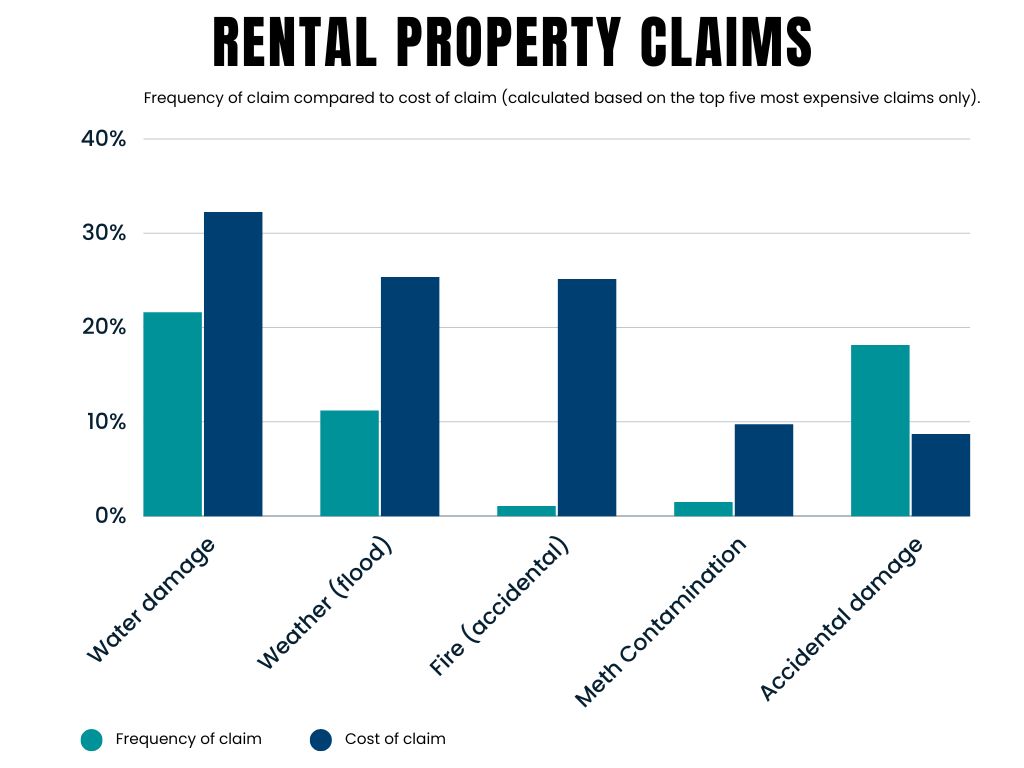

Frequency of claim vs. cost

The above numbers are based on frequency (i.e number of claims made). We also analysed the payout values for rental property claims. The graph below shows the top five losses by value. This data is presented alongside the frequency of each of these claims. It illustrates that losses like fire are uncommon but are high in value.

Fire-related claims constituted a mere 1.1% of the overall number of rental property claims, but made up 25% of the total value of claims paid. This underscores the potential devastation that fires can cause to rental properties. The significance of this cannot be overlooked, highlighting the importance of equipping your rental properties with smoke alarms, and fire extinguishers. By taking these simple proactive measures, you can significantly reduce the risks associated with fires and safeguard your valuable assets and your tenants.

Final word

Understanding the potential risks involved in rental property ownership can help landlords to better prepare for and protect their investments.

Proactive and pragmatic management of landlord risk is a form of insurance in its own right. In our experience, with the losses we see on a daily basis, a landlord that focuses on tenant selection, tenant vetting, regular property inspections, fire extinguishers in kitchens, regular maintenance including plumbing and electrical checks will outperform and not contribute to the statistics in this article.

Choosing an insurance provider that knows landlord insurance and who provides an insurance policy that is dedicated to the diverse needs of rental property owners is the icing on the cake for a well-rounded risk mitigation approach to landlording.

Learn more about initio’s Landlord insurance cover

The statistics presented in this article are based on a comprehensive analysis of claims data from initio for the calendar year of 2022, spanning our entire claims portfolio. Please note that all figures are approximate and have been calculated to provide a representative view of the claim trends during this period.