Why do Premiums Increase?

Insurance premiums don’t increase simply so the insurer can make more money – they increase so the insurer can afford to pay claims and stay in business. These are just some of the reasons why initio has seen premium increases in recent years.

WHERE DOES MY PREMIUM GO?

In this example we have used a typical house insurance premium of $997.28 inc GST to depict the actual levies and taxes paid, and the approximate distribution of the remainder of the premium.

METHAMPHETAMINE

IAG pays out $14 million in methamphetamine claims on residential properties each year. IAG receives up to 80 new Methamphetamine claims each month. The average decontamination claims costs $25,000. With detailed testing ranging from $3,000 to $10,000, and house decontamination costing between $2,000 and $50,000.

NATURAL DISASTERS AND WEATHER EVENTS

2 Days of wild weather in March 2016 cost insurers $30 million, with 687 House and Contents Claims, costing over $2 million.

2 Days of wild weather in March 2016 cost insurers $30 million, with 687 House and Contents Claims, costing over $2 million.

12 months later in March 2017 a months’ worth of rain fell in 24 hours that costing insurers another $42 million. This time the effect was greater on homes with 5824 House and Contents Claims that costing $24.5 million.

GOVERNMENT LEVIES

Government imposed Fire Service Levies increased from 1 July. If you are renewing cover after this date the additional cost to you is $41.40. The annual cost of Fire Service Levies is $146.28.

Government imposed Earthquake Commission Levies are increasing from 1 November. If you are starting your cover on or after this date the cost of you insurance will increase by $69. The annual cost of Earthquake Commission Levies is $276.00.

EARTHQUAKES AND REINSURANCE

Before the Canterbury 2011 earthquakes, reinsurance costs made up about 7% of total cost of house insurance, now that amount has tripled to about 20%. The risks associated with natural hazards were grossly underestimated before the 2011 quakes.

The Natural Disaster Fund has paid out $9.5 Billion so far in claims to people affected by the Canterbury Earthquakes. It is expected another $550 Million will be paid out for claims relating to the 2016 Kaikoura Earthquake.

INCREASED CLAIM COSTS

The Health and Safety at Work Act 2015 has meant increased compliance costs for all building repairs and more on site safety requirements. For example, a single tradesperson is no longer able to access a roof via a ladder; now there must be two tradespeople on every job, and they must use a scaffold.

In April 2016, the Asbestos Regulations came into force, as a result, the cost of removing Asbestos Containing Material has increased significantly. For example, a straightforward textured ceiling removal that may have cost $1,000 in 2015 would now cost over $5,000 to remove.

INCREASES IN BUILDING COSTS

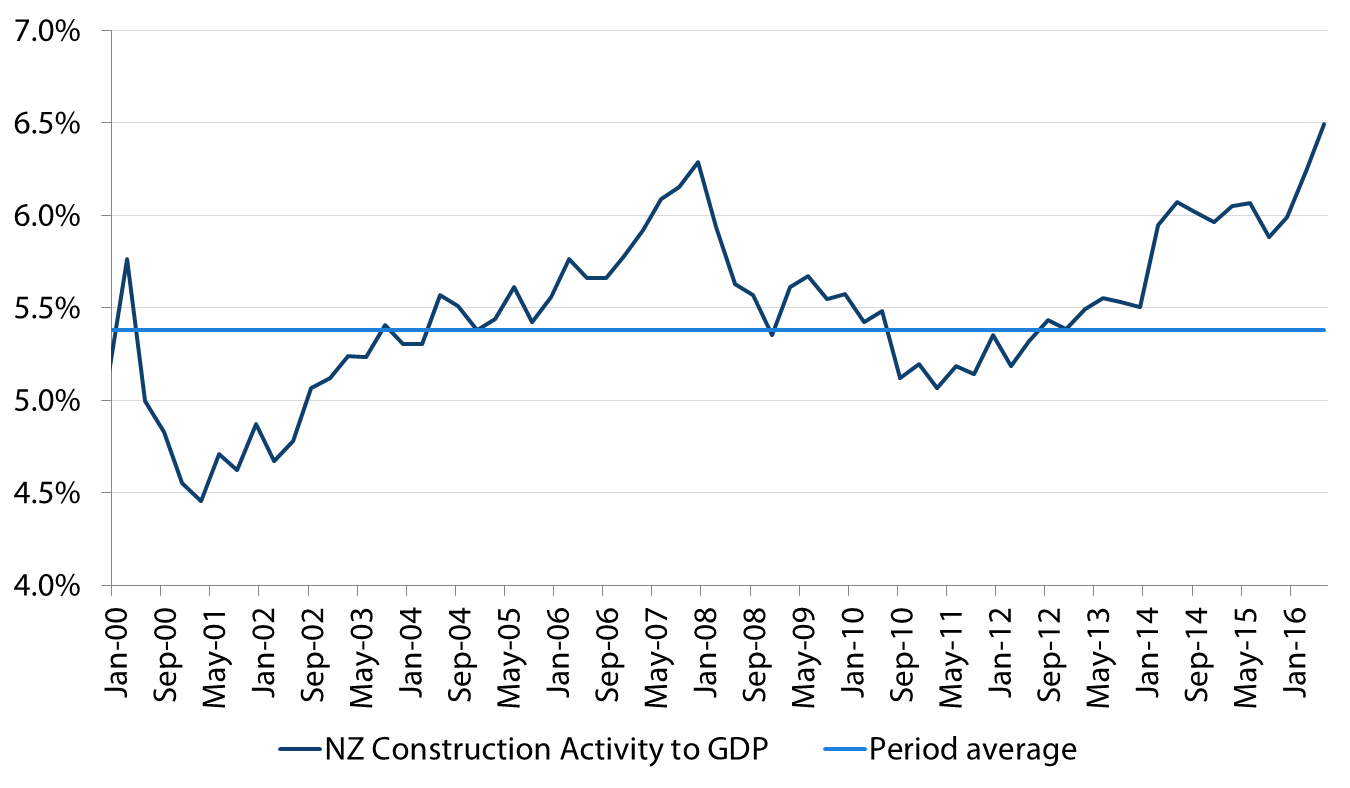

Strong demand and not enough supply has seen the average cost of building a new home in New Zealand’s four largest cities rise by 21.09 percent since the previous peak, (and last building boom), in 2007.

Strong demand and not enough supply has seen the average cost of building a new home in New Zealand’s four largest cities rise by 21.09 percent since the previous peak, (and last building boom), in 2007.

There is more to building cost inflation than simply labour and material cost escalation. Other significant cost increases can be found in health and safety compliance and higher levels of specifications being imposed such as higher seismic loads.

USEFUL ARTICLES

How are house insurance premiums calculated?

Why has my premium changed?

Why does the global insurance pool impact my premium?