It’s not you, it’s us

A candid take on initio’s approach to you and your home

At initio we are ‘all-in’ on customer experience. We ruthlessly pursue customer satisfaction with our technology, support and communications …. But only for a certain type of customer. In short, we are not for everyone.

Yes, we’re audacious enough to say: “Sorry, we can’t be your insurance provider” – at least not if it means compromising the ethos that underpins our brand, or transacting with you in a way that doesn’t celebrate the use of our tech. We provide superior ease of insurance and customer service, but only to a specific kind of customer who appreciates and respects our ‘digital by default’ approach.

Catering to the Modern, Digital-Savvy Customer

Our business model is laser-focused on a modern, self-reliant breed of customers. The digital age has dramatically reshaped the insurance industry, and initio remains at the forefront of this transformation. We are designed for customers who value autonomy, speed, and convenience, rather than the traditional, hands-on approach.

Customers who are comfortable transacting online, managing their property portfolios with digital tools, and who comprehend that competitive premiums and high-touch hand-holding services are often mutually exclusive, are our ideal clientele. For these customers we are digital by default, and human when you need us.

The Interplay of Technology and Affordability

“Why can’t you just start the policy for me over the phone”

“Why don’t you call me every year when my policy renews so we can have a chat about it”

“Why can’t you just send me your bank account and I’ll transfer the premium funds”

“Send me a quote”

It’s a ‘no’ on all fronts. The truth is, high-touch insurance services involve considerable operational costs – think travel, long-winded phone calls, time, and administration. We’ve spent over 10 years building a digital platform that substitutes for these things; its frictionless insurance, that’s quote in one click, cover in 2 minutes, claim in an instant. By utilising technology to automate many aspects of our services, we increase efficiency and are able to offer competitive pricing.

Our system has been designed to suit a certain type of customer, and it’s not for everyone.

This doesn’t mean we shirk our responsibility to our customers that embrace our technology. Quite the contrary – we provide comprehensive digital and phone support, and abundant online resources to help.

Why we decline to insure some houses

Sometimes we have to say no to insuring your house. It’s not you, or your house, it’s simply the way we want to run our business and the rules we, and our insurer, have had to create to be able to offer our services long-term.

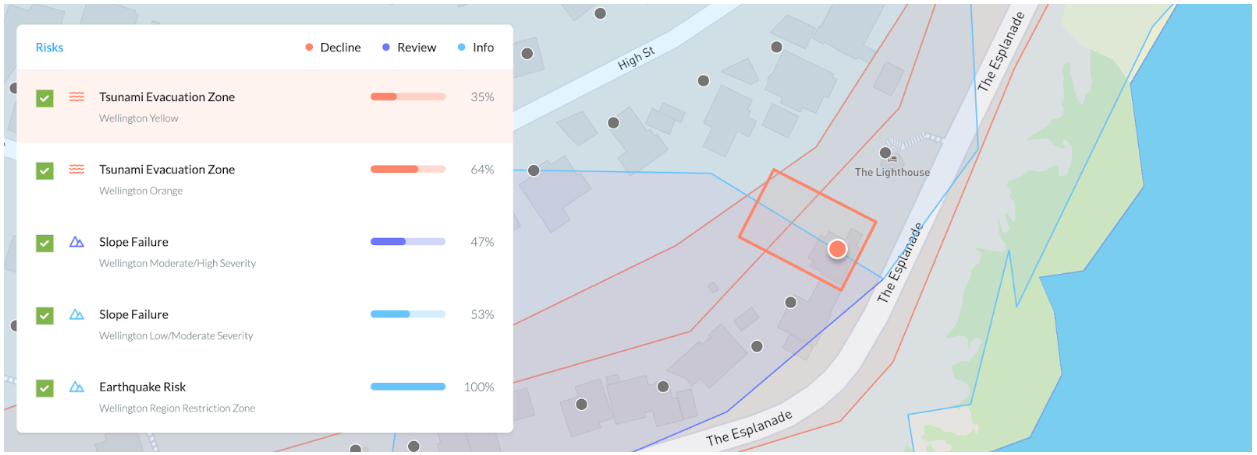

It’s digital too: The primary decision making on whether or not to insure your property is done by a smart tool we built called ‘Locatio’. When you type in your address with initio, Locatio makes decisions about whether initio can provide cover by using things like council property data, flood maps, earthquake and land risk.

In order to remain a sustainable and successful insurance provider we choose to focus on certain types of houses, and this means that there are some locations where we can’t provide cover, and certain risk exposures such as flood or land instability that are just not our bag.

We are constantly updating our business and underwriting rules, so just because we say no today, doesn’t mean that it’s a no forever.

You also need to know that we cannot sell you something that isn’t right for your situation either. So if your property does not fit our product we’ll decline to provide cover, and we don’t mean any offence by this.

The cost is the cost

A number of factors go into calculating the total cost of your home insurance, including location, age of the property, and other things like government-imposed levies. Our award-winning insurance technology computes the insurance cost, and we rely on that to run our business. The premiums need to be set at a level that allows the insurer the margins to continue to pay claims and reinsurance costs. In short, the cost is the cost.

Learn more about how the insurance risk component of your insurance cost is calculated

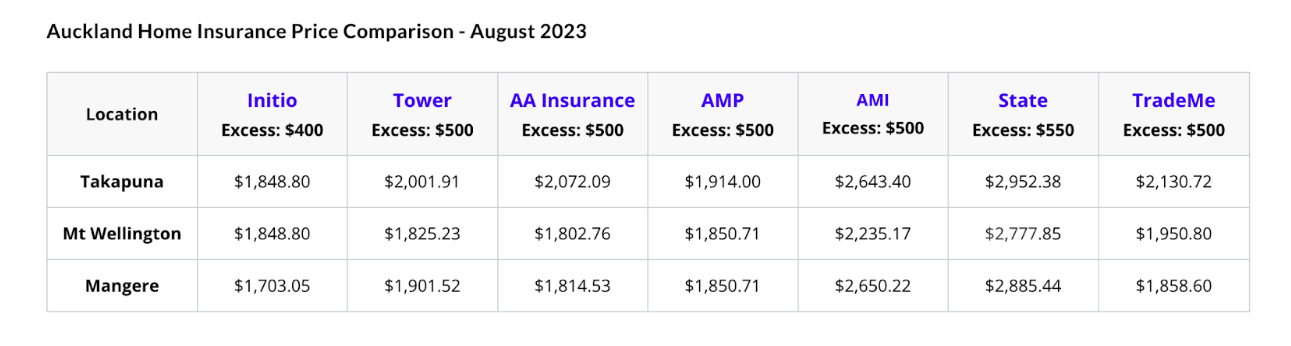

It’s 100% your choice whether or not to accept the insurance cost we offer. You can ring or email and challenge a cost but ultimately it’s out of our hands as the system has spoken. You need to know though that we work incredibly hard to maintain competitive premiums for our customers. We do this by continually investing in our technology for efficient processes, negotiations with our insurer, constantly refining the rules that determine how risky our portfolio of houses is (ultimately the more aggregated risk we take on, the bigger our premium pool needs to be).

Our efforts to keep premiums competitive have been confirmed by feedback from our customers and also by financial resource websites like Moneyhub.

Source: Moneyhub

It’s simply not possible to be the most competitive all of the time, and we implore our customers to take a long and holistic view of their insurance that takes account of things like support (can you get you easily get ahold of your insurer), claims responsiveness, ease of use, technology and overall confidence in your provider.

It’s worth bearing in mind that not all policies are built the same, so just comparing price vs price doesn’t quite cover it. We highly recommend using our comparison tool if you want to see how we stack up when you also take the policies into consideration.

An Unapologetic Philosophy

Our philosophy is blunt but honest: “We are not for everyone”. Our model isn’t all things to all people, and that’s intentional. We’re looking for customers who align with our ethos – those who want a superior digital service.

While we understand some may expect more traditional customer service methods, we respectfully suggest they may be happier elsewhere. This is not a dismissal, but a candid admission that our service model may not suit everyone’s expectations.

In sum up, initio is unyieldingly committed to delivering our unique brand of customer experience, one that is unabashedly shaped by the needs of modern, digital-savvy customers. While our approach may not resonate with everyone, we are firm in our refusal to compromise on the affordability and efficiency that our model provides.

To our customers who find value in what we offer, we welcome you wholeheartedly. To those who don’t, we don’t hesitate to say: “We are not for you” And that’s how we maintain the balance that allows us to continue delivering what we believe is the optimal blend of service and affordability in today’s market… all driven by our technology.