Claim trends report 2024

What claims cost the most, and what are the most common claims of 2024?

As we approach the end of 2024, we’ve taken a closer look at the trends in claims across the range of insurance policies we offer. The main ones being holiday homes, rental properties, owner-occupied homes and vehicles. Understanding these trends helps us, as your insurance provider, to stay on top of the risks that matter most to you – and also gives a bit of insight into what’s happening out there in the real world. Here’s a summary of what we’ve found.

Please note these figures only cover the most common categories. They are not an all-inclusive list and may not total 100%.

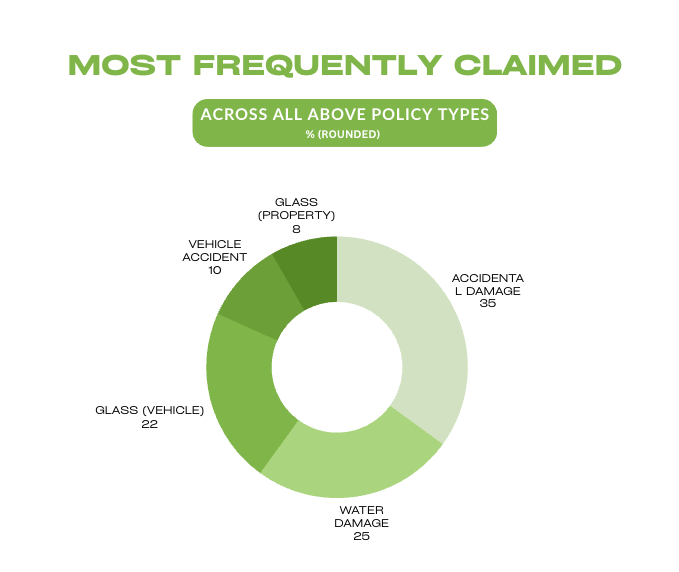

The most common claims this year

Across all policy types discussed in this article – Own Home, Holiday Home, Rental/Landlord, and Vehicle – two trends dominate: accidental damage and water damage.

Accidental damage is one of the most common types of insurance claims because it covers a wide range of unexpected scenarios. Accidents are often unavoidable, even with the best precautions, which is why having comprehensive insurance is so important. It ensures you’re protected from the financial impact of repairs or replacements, helping you get back to normal quickly without unnecessary stress.

Water damage, including hidden water damage, is another significant area of cover. Hidden water damage applies to gradual leaks from internal water pipes or tanks that aren’t visible. Coverage is subject to specific conditions and limits, so it’s worth understanding what’s included in your policy. Sudden water damage, such as from a burst pipe, is generally covered under most policies.

For more details about how we handle water damage, visit our water damage support page – it’s always good to know exactly what’s included.

For more information:

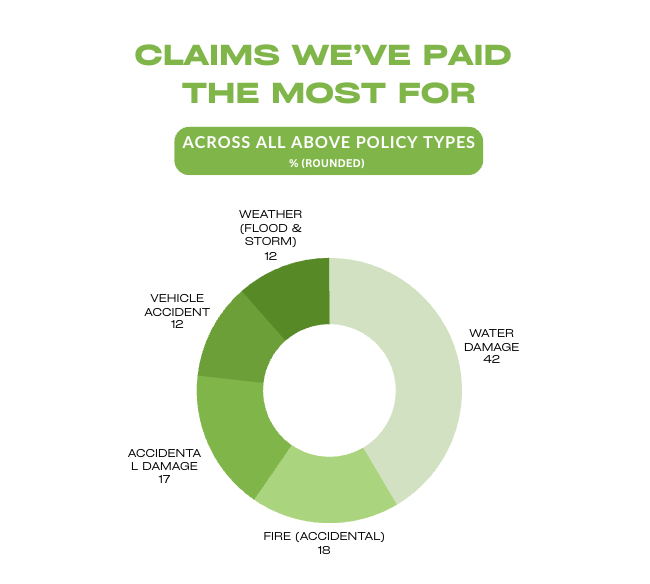

The most expensive claims across all policy types

While frequency tells one side of the story, cost paints a different picture. Here’s a look at the claims that we’ve paid out the most amount of money for this year:

Some key insights stand out when it comes to the costliest claims. Thankfully, weather-related claims have dropped a few spots this year, providing some much-needed relief.

While accidental damage was the most frequent reason for our claims, it accounts for just 10% of the total payouts – indicating many smaller, less costly incidents.

When accidental fires occur, they’re among the most financially costly claims. These events often result in extensive damage, sometimes requiring a complete rebuild of the home.

Prevention is always the best defence against accidental fires. Simple steps like never leaving candles or cooking unattended, regularly testing smoke alarms, and ensuring your electrical systems are safe can greatly reduce the risk. While the financial cost of a fire can be substantial, the threat to human lives is immeasurable.

For more information:

General insights by property type

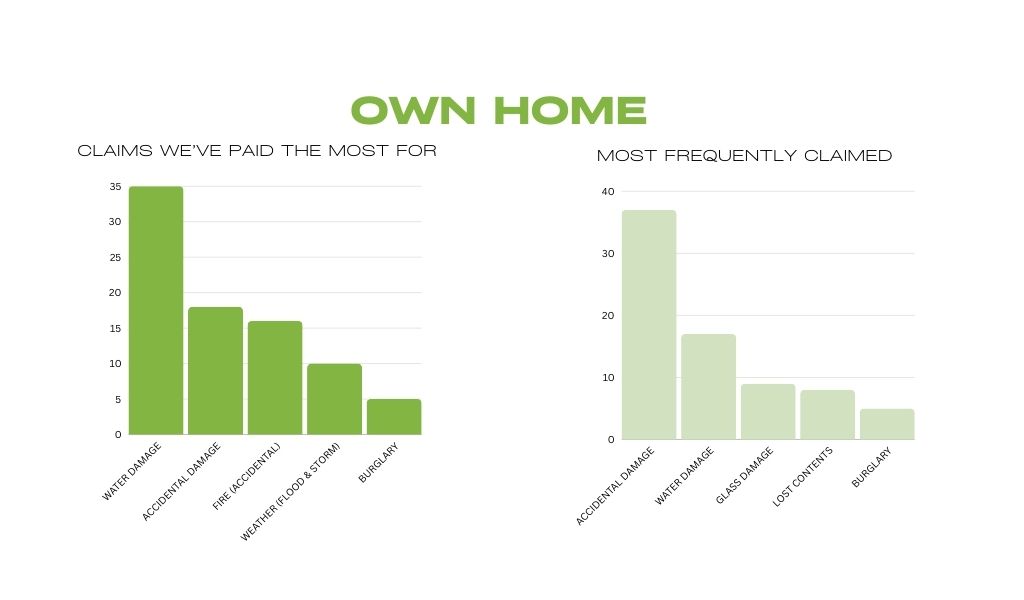

Own Home/Owner-Occupied

Weather has raised its ugly head again this year, but thankfully we’ve been spared the extreme damage experienced in 2023. Historically, summer is a season when storms and flooding can cause significant damage, so it’s a good time to take precautions to protect your property. If you’d like to learn more, check out our support articles for helpful tips and information:

Rental/Landlord

Similar to own home and holiday home insurance, water damage and accidental damage are the most common claims for rental properties. These issues often arise from the higher turnover of tenants or insufficient regular maintenance. What sets rental properties apart, however, is the added risk of loss of rent & malicious damage cover.

Learn more about these topics:

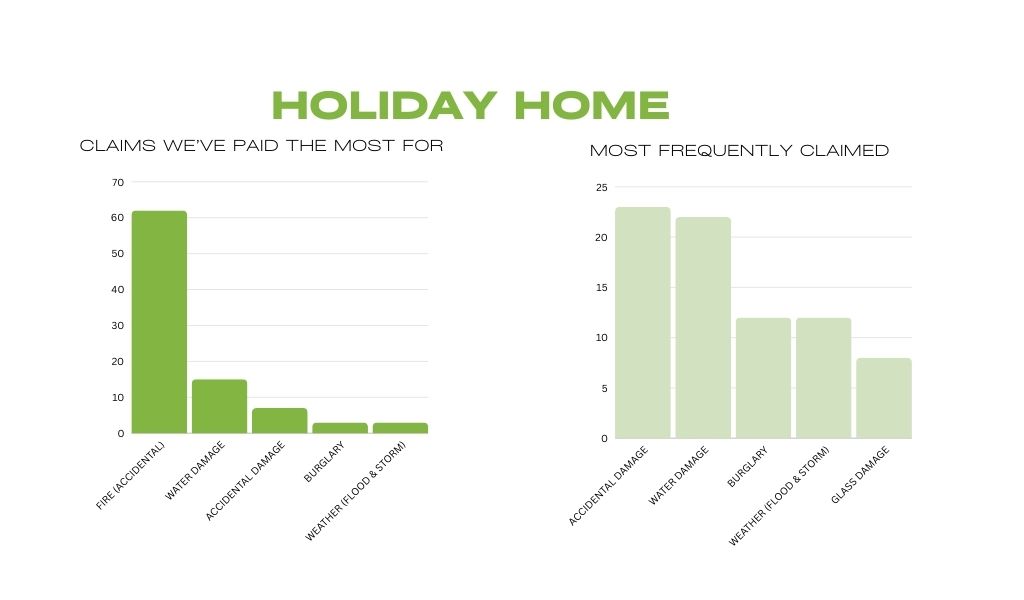

Holiday Home

After the usual suspects of accidental damage & water damage, these properties see a higher risk of burglary and weather-related claims. Being unoccupied for long stretches makes them vulnerable, particularly during storm seasons. Burglary ranks as the third most common issue. Our Holiday Home insurance basics article offers helpful tips on mitigating these risks.

For more information:

- The differences between Holiday Home & Own Home cover

- Holiday Home basics

- Is my unoccupied home still covered?

Vehicle

One of the main standouts in 2024 is glass damage – it’s the most common claim by far. These claims, while annoying and inconvenient, usually don’t cost much to fix.

When we look at the vehicle claims we’ve paid out the most for, major accident damage tops the list. The good news? The Roadside Assist portal is now available for vehicle customers who’ve added the Roadside Assist feature to their policy. If you haven’t added it yet and want to know more, you can start here.

Another common (and costly) culprit is damage from static collisions – when your car meets an immovable object.

For more information

Roadside Assist for initio vehicle customers

When we look at the vehicle claims we’ve paid out the most for, accident damage tops the list. The good news? Roadside Assist Online is now available for vehicle customers who’ve added the Roadside Assist feature to their policy. If you haven’t added it yet and want to know more, you can start here.

Another common (and costly) culprit is damage from static collisions – when your car meets an immovable object. And we hate to break it to you, but that pole you reversed into didn’t sneak up behind you.

For more information

What does this mean for you?

These trends highlight the importance of staying proactive with maintenance, securing your property, and ensuring your insurance is comprehensive enough to cover frequent and high-cost risks. As your insurance provider, we’re here to help – whether it’s providing advice on minimising risks or ensuring your cover matches your needs.

Did you find this interesting? You might also enjoy our article on the weird and wonderful claims from this past year.

The statistics presented in this article are based on a comprehensive analysis of claims data from initio for the calendar year of 2024 (1 Dec 2023 – 27 Nov 2024), spanning our entire claims portfolio. Please note that all figures are approximate percentages, calculated to offer a representative overview of claim trends during this period. These figures only cover the most common categories. They are not an all-inclusive list and may not total 100%.