Calculate your Sum Insured

The rebuild sum insured is an important part of your insurance policy, so it’s important you take some time to get a good estimate.

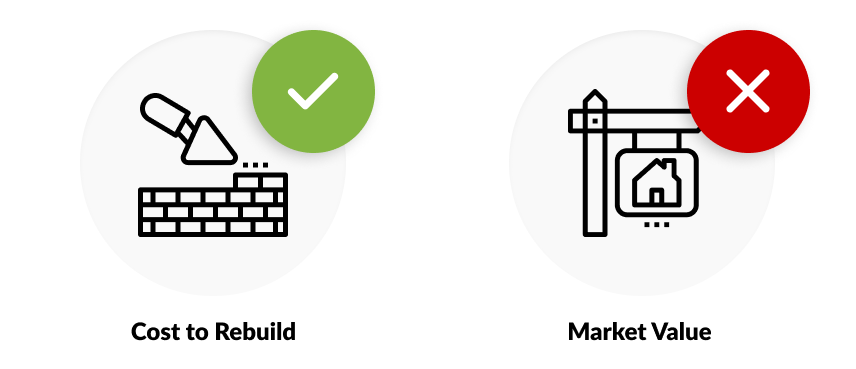

Rebuild Sum Insured, Not Market Value

Your sum insured should equal the cost to fully rebuild your house to its current size and standard, in today’s building costs.

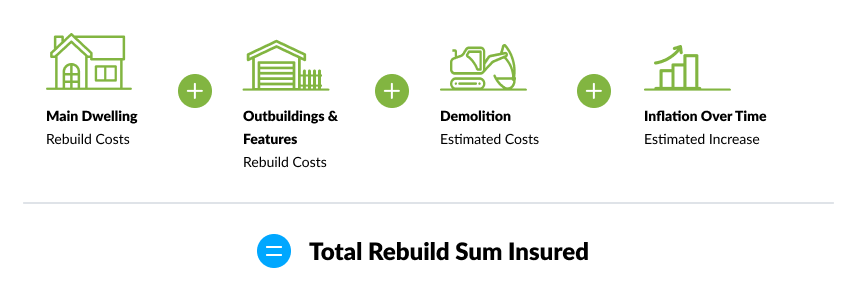

Unique feature & inflation considerations

As well as the house itself, rebuild costs of other structures like fences, and swimming pools need to be included.

Remember that if your house needs to be completely rebuilt after damage, there are extra demolition costs involved.

It’s also a good idea to add a buffer to account for building costs that tend to rise with inflation over time.

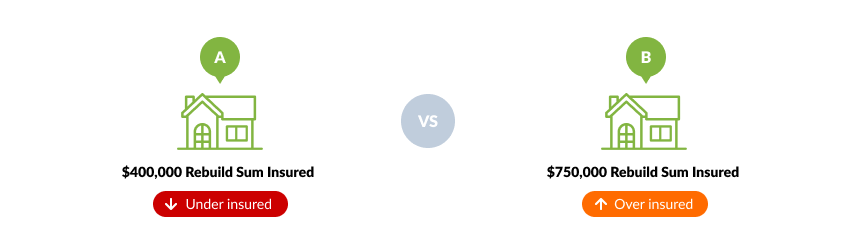

Rebuilding examples

Imagine two neighbours with identical houses that would cost $500,000 to fully rebuild.

- Neighbour A doesn’t give their sum insured much thought, and use $2,000 a metre to insure for $400,000

- Neighbour B thinks the sum insured should equal their house’s market value, and insure for $750,000

Now imagine an earthquake completely shakes both houses to the ground.

Neighbour A is under-insured. The lower of the sum insured or rebuild cost is their max payout, so they receive $400,000 from the insurance company. Neighbour A faces being $100,000 short if they want to build a similar house.

Neighbour B is over-insured. The max payout is the cost to rebuild, as it’s lower than the sum insured. They receive $500,000, which is enough to rebuild but they’ve been paying for extra cover they don’t need.

Getting it right

If the neighbours accurately insured for (or slightly over) $500,000, they would save the stress of being short when they rebuild, while also saving by not over-paying any premium.

Why there’s a minimum and maximum sum insured available when selecting your sum insured

You will note that when you are setting your sum insured, we provide a range of values to choose from with an absolute minimum and maximum sum insured. These values are calculated using the floor area of your home and/or outbuildings.

Minimum Sum Insured

This reflects the lowest realistic rebuild cost per square metre to re-build a basic home. The minimum protects you from choosing a figure that’s unrealistically low and leaving yourself too short in the event of a claim.

Maximum Sum Insured

This reflects the upper realistic limit of rebuild costs, based on your home’s floor area. Setting your sum insured higher than this won’t give you a bigger payout—it just means you may pay unnecessarily high premiums.

If you believe your situation calls for cover beyond the maximum, please contact our support team to discuss whether we can assist.

💡 Note: Building costs vary depending on materials, design, and location, but most homes fall within the range provided.

Although we provide a range, you are responsible for determining the sum insured of your property. If you determine that figure falls beyond the range available, please get in touch and provide further detail.

Include GST

Any nominated sums insured on an initio policy include GST, therefore before confirming your GST preference, add in the GST component.

Still not sure?

We recommend getting an estimate using the Cordel Sum Sure Calculator.

It uses council data on things like your house’s size, building materials etc to estimate the rebuild costs of your house. You can then compare this to what you have in mind.

Cordell Rebuild Calculator

About the advice on this page

As your insurance provider we are able to give advice around our products but unfortunately, as we are not qualified to value homes, we are unable to provide any specific advice in regards to setting your sum insured. We recommend using available tools as a guide, such as the Cordell site, or contacting an expert such as a builder, architect or quantity surveyor.

Related Articles