Understanding flood risk and zones – a guide for property owners

Flood risk is becoming an increasingly significant issue for property owners in New Zealand due to the growing frequency and severity of weather events. This risk often translates into financial hardship due to the damage caused and the potential for increased insurance premiums. Certain areas, like Edgecumbe and Westport, for example, face heightened challenges, with insurance becoming harder to secure.

To help you navigate these challenges, this guide combines insights on flood risk assessment and the implications of living in flood zones, using advanced tools like Risk Management Solutions (RMS) and council-provided data.

Measuring flood risk

Flood risk is determined by two key factors:

- Frequency: How often floods are likely to occur.

- Severity: The potential impact and damage caused by those floods.

Initio is committed to providing transparent and accurate information to help you protect your property.

At initio, we use Risk Management Solutions (RMS) data to assess properties’ flood risk. RMS is a global leader in risk modelling and analytics. They use advanced technologies, scientific data, and sophisticated modelling techniques to assess natural disaster risks, including flooding. RMS determines flood layers by analysing:

- Historical flood data

- Topographical information (land elevation and shapes)

- River systems and water flow patterns

- Rainfall data and climate patterns

- Soil types and ground absorption rates

- Man-made structures like dams and levees

When you get a quote, and the property you’re quoting is in a flood risk zone according to the RMS modeling, we will show you a message detailing what risk has been found. These are as follows:

- “Flood Risk – RMS Flood 50 Year Return”: There’s a 1 in 50 chance of a significant flood in any year, or a 2% chance of a flood occurring in any year.

- “Flood Risk – RMS Flood 30 Year Return”: This indicates a 1 in 30 chance of significant flooding each year, or a 3.3% chance of a flood occurring in any year.

These year values represent the probability for the scale of flooding that needs to occur for the water to reach this property. So when you hear about “one in a hundred year flood”, or “one in 50 year floods”, that is what those flood risks mean; if a “one in 30 year flood” occurs, water is likely to reach properties that fall in the RMS 30 Year flood model.

The risk information don’t mean that a flood will only happen once in 100, 50, or 30 years. As we saw with the Auckland flood events from 2023, multiple flood events can occur in quick succession.Ultimately these are modeled risks, and real world outcomes may vary, but they are a way to better predict flood risks and keep insurance accessible for New Zealand.

However, it’s crucial to understand that frequency doesn’t always correlate directly with severity. Flood severity refers to how damaging a flood might be, regardless of frequency. For instance, a less frequent flood might cause significant damage if it is severe, while a more frequent flood might have a lower impact.

When you get a quote online, if there is a flood risk associated with the address you have provided we will display the risk found on the RMS dataset based on the location of the property.

This information helps determine whether we can offer immediate insurance cover or if further review is needed. However, it’s important to note that these are probabilistic models and real-world outcomes may differ.

Understanding flood severity

While frequency tells us how often flooding might occur, severity helps us understand the potential impact on your specific property. We assess severity by looking at several key factors that combine to create a complete picture of risk:

-

Predicted flood water depths (ranging from shallow surface flooding to depths of over 3 meters)

-

The percentage of land potentially affected

-

Your building’s position on the property

-

Natural drainage patterns

-

Existing flood protection measures

-

The building’s design and construction

The interaction between these factors can significantly influence the actual risk to your property. Here are some examples:

-

A property might be in a 30-year flood zone with a predicted 2.5-meter water depth, but if this only affects a small corner of the section where no buildings stand, the practical risk might be manageable.

-

Conversely, a property in a 50-year zone with a lower 0.5-meter predicted depth could present higher risks if the water would cover most of the land and directly impact the building.

-

A property with moderate flood frequency but high predicted water depths (3+ meters) covering significant building areas would typically represent a more serious risk which may be outside of our capacity to insure.

Our website continually evolves as data and modeling capabilities improve. The rules we use to evaluate properties are regularly updated to reflect the latest RMS data and our growing understanding of flood risks in New Zealand. This means that assessments can change over time as we refine our approach and incorporate new information about flood risks and their potential impacts.

At Initio, we use this comprehensive understanding of both frequency and severity to make balanced insurance decisions. Our approach is designed to be practical – we can typically provide coverage even when some flood risk is present, however not all properties are able to be insured by Initio, depending on the risks involved.

Understanding Flood Zones and Mapping Tools

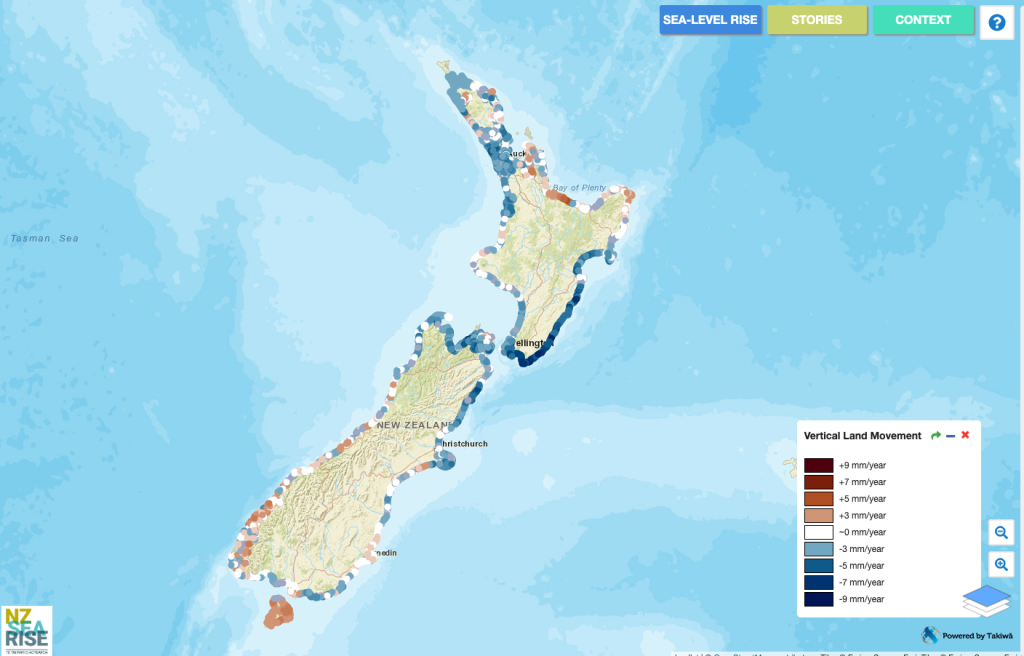

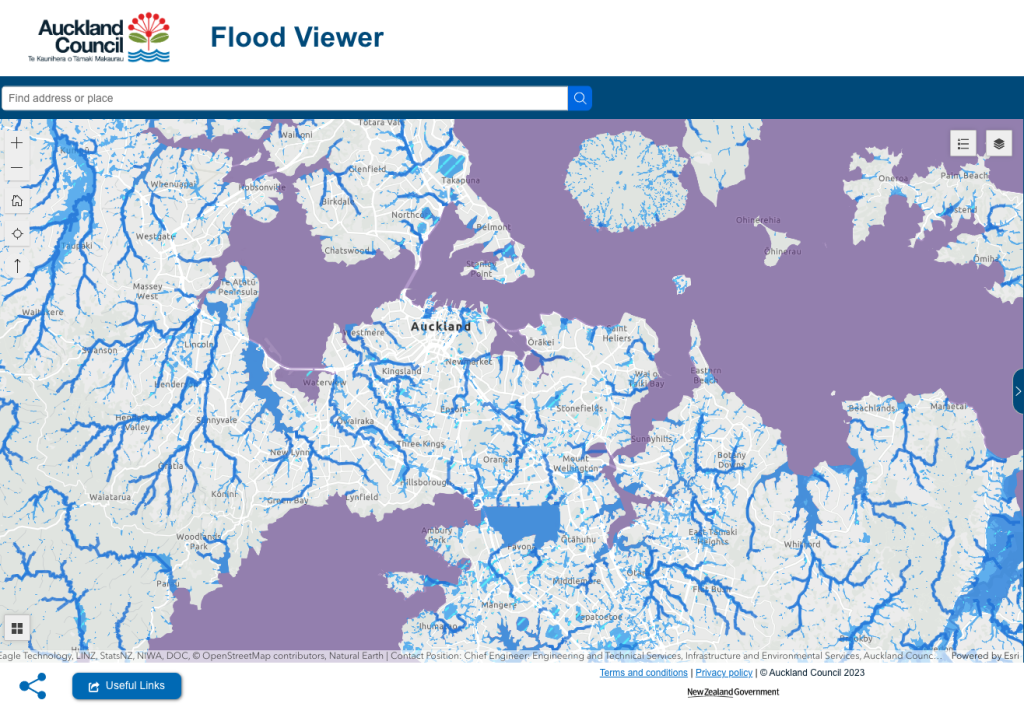

In addition to RMS data, tools like the Searise website, local council hazard maps, the property’s history and your own LIM report provide valuable insights into flood risks. These tools help both insurers and property owners understand sea-level rise, vertical land movement, and local flood hazards. With these resources, you can view your property’s flood risk, explore hazards like river overflow and storm surges, and prepare accordingly.

Searise example

Auckland Council flood mapping example

Local councils also play a crucial role in managing flood risk by improving infrastructure, such as drainage systems, which are increasingly under pressure. Ensuring that these systems are up to standard is essential in reducing flood risks for homeowners.

Why might my council’s flood risk assessment differ from RMS data?

It’s possible that your local council’s flood risk assessment may differ from the RMS data we use. This can happen for several reasons:

- Updated information: RMS may have access to more recent data or use more advanced modeling techniques.

- Different focus: Council assessments might focus on specific local concerns, while RMS provides a standardized national assessment.

- Varying methodologies: The methods used to assess flood risk can differ between organizations.

- Broader considerations: RMS data may take into account factors beyond what local councils typically consider.

If you have concerns about discrepancies between council and RMS assessments, we encourage you to contact us for further clarification.

How Does Flood Risk Impact Insurance?

Suppose your property falls within a high-risk flood zone. In that case, initio uses all information available to help decide whether immediate insurance cover can be offered or if custom terms would be required.

While insurance can help protect against flood-related damage, it’s important to manage the risks proactively. This might involve flood-proofing your property, improving drainage, or making structural changes to better withstand flood events.

Flood risk can vary across properties depending on:

- Specific property location within a flood zone.

- Local topography and elevation.

- Drainage systems and recent land developments.

What If I’ve Reduced My Flood Risk?

If you’ve taken steps to reduce your property’s flood risk, such as installing barriers or improving drainage, let us know. These improvements would be considered when assessing your property’s flood risk for insurance purposes.

Summary

With the growing threat of severe weather events, understanding flood risk and using available resources is essential for property owners in New Zealand. By leveraging data from tools like RMS and local flood maps, you can make informed decisions, better protect your property, and ensure you are adequately insured.

For more information or help understanding your property’s flood risk, reach out to our support team at initio. We’re here to provide the transparency and guidance you need to manage these risks effectively.

Remember, understanding your flood risk is the first step in protecting your property. Stay informed and prepared!

Related articles & useful links

- Five tips to insuring in a flood zone

- Risk Management Solutions RMS

- Searise

- Auckland Council’s flood zone maps

- What is an alluvial fan – and why does it matter for property owners?

IMPORTANT – RMS Moody’s disclaimer

This report, and the analyses, catastrophe modelling results and predictions contained herein (“Information”), are based on data provided by Initio Limited, and compiled using proprietary computer risk assessment technology of Moody’s Analytics, Inc. and its affiliates (“Moody’s”). This Information is a single copy, copyright protected work of Moody’s that contains confidential and proprietary information of Moody’s. As with any model of physical systems, particularly those with low frequencies of occurrence and potentially high severity outcomes, the actual losses from catastrophic events may differ from the results of simulation analyses. Furthermore, the accuracy of predictions depends largely on the accuracy and quality of the data used by Initio Limited. The Information is owned by Client or provided under license to Initio Limited and is either Client’s or Moody’s’ proprietary and confidential information and may not be shared with any third party without the prior written consent of both Initio Limited and Moody’s. Furthermore, this Information may only be used by the recipient in connection with, as applicable, (i) Initio Limited’s imminent placement of insurance or reinsurance; or (ii) the recipient’s 3 regulatory activities in relation to Initio Limited; and always for internal purposes only and for no other purpose, and may not be used under any circumstances in the development or calibration of any product or service offering that competes with Moody’s. You are not authorized to use, copy, modify, disclose, and/or distribute this Information in whole or in part in any form, except as expressly and specifically permitted under a written agreement signed by Moody’s. Any unauthorized use, copying, modification, disclosure, or distribution of this Information will constitute an infringement of Moody’s intellectual property and your agreement to pay list price for the use of the product or application associated with this Information, in addition to any applicable penalties or damages or other remedies available under applicable law. The recipient of this Information is further advised that Moody’s is not engaged in the insurance, reinsurance, or related industries, and that the Information provided is not intended to constitute professional advice. Moody’s including its parent, subsidiary and other affiliated companies are all beneficiaries of this disclaimer. MOODY’S (AND ITS PARENT, SUBSIDIARY AND OTHER AFFILIATED COMPANIES) SPECIFICALLY DISCLAIMS ANY AND ALL RESPONSIBILITIES, OBLIGATIONS AND LIABILITY WITH RESPECT TO ANY DECISIONS OR ADVICE MADE OR GIVEN AS A RESULT OF THE INFORMATION OR USE THEREOF, INCLUDING ALL WARRANTIES, WHETHER EXPRESS OR IMPLIED, INCLUDING BUT NOT LIMITED TO, WARRANTIES OF NON-INFRINGEMENT, MERCHANTABILITY AND FITNESS FOR A PARTICULAR PURPOSE. IN NO EVENT SHALL MOODY’S (OR ITS PARENT, SUBSIDIARY, OR OTHER AFFILIATED COMPANIES) BE LIABLE FOR DIRECT, INDIRECT, SPECIAL, INCIDENTAL, EXEMPLARY, OR CONSEQUENTIAL DAMAGES WITH RESPECT TO ANY DECISIONS OR ADVICE MADE OR GIVEN AS A RESULT OF THE CONTENTS OF THIS INFORMATION OR USE THEREOF.