Why does my rebuild value change?

The cost to rebuild your home is constantly changing. To try and help with changing construction costs and other factors that may affect the rebuild value of your home, each year we auto-update your sum insured.

For Monthly payment policies the auto-update to your sum insured will be automatically applied once per year, at the anniversary of your policy. One month prior to the change we will notify you of the auto-updated sum insured and invite you to login to your dash to change the sum insured to an amount of your choosing. If you change your sum insured this amount will be locked in for the anniversary renewal of the policy. If you do nothing, then at the anniversary renewal (ie the following month) the sum insured will update to the amount we have advised, and new insurance cost will be charged to your credit card.

For Annual payment policies the auto-update will be applied during your renewal process, where you can further adjust the sum insured prior to confirming you renewal and making payment.

A change in sum insured affects the premium you pay. This is because a higher sum insured means more insurance cover, which equates to more premium to cover that risk. At the same time, your cover may have also had a premium rate or levy change. By selecting the ‘change’ icon in your dashboard, initio makes it easy to see how changes to you sum insured affect your premium. Its easy and responsive, and we are here to help if you need assistance.

What things can impact the rebuild value of my home?

- Supply chain issues and accessibility of materials.

- Changes in the cost of transportation and shipping.

- Inflation and interest rate changes.

- Changes in the cost of labour and in particular construction related wages.

- Cost of waste disposal

- Cost of compliance costs (eg council consents, heath and safety, insulation rules)

- Accessibility of the the property

This is not an exhaustive list but all of these are contributing to changes in the overall cost of constructing, rebuilding or repairing a home.

Changes in construction costs vary by region too due to the availability of labour, and also local rates.

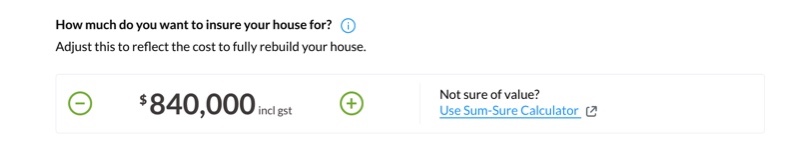

So what sum insured do I use?

The auto-updated sum insured we do at your policy anniversary is a guide to your sum insured only. It does not account for your unique situation such as renovations or improvements to the home, or the accuracy of the sum insured your originally chose. We are not attempting to recalculate the insured value of your home, and you are responsible for choosing an accurate sum insured. If your sum insured is not right for you, it might not be enough to rebuild your home to the same size and quality.

Because the things that contribute to your rebuild value are constantly changing, it’s almost impossible for you to select a sum insured that will work for the entire annual insurance period. The best approach is to choose a sum insured that reflects the homes approximate rebuild cost and allows for demolition costs, escalation of construction costs and other site improvements (such as retaining walls, pools, sheds, fences).

We strongly recommend that you use your policy anniversary as an opportunity to review the sum insured of your home. You can use the SumSure rebuild estimator to help. This is a simple tool that can provide a quick and easy estimate of your home’s rebuild value, and at the very least you should use this tool.

Better still, there are skilled professionals that you can engage (at a cost) to provide a detailed report on the rebuild value of your home. Construction Cost Consultants are one of those, and can provide residential rebuild valuations

Learn more about working out your sum insured.