Kiwis love their houses. Protect yours with our comprehensive cover.

Get a quote in seconds and cover online in minutes with New Zealand’s easiest house insurance.

What does our House & Contents insurance cover?

Full House Replacement

Rebuild or repair your house and other structures up to your replacement value.

Personal Contents

Replace or repair lost or damaged belongings on a new-for-old basis (available as an add-on with any house policy).

Legal Liability

Cover legal costs if an accident injures someone, or causes damage to other's property.

Benefits of our House Insurance cover

-

Temporary Accommodation

$20,000 of alternative accommodation if your damaged house can’t be lived in.

-

Reduced Glass Breakage Excess

Reduced $250 excess for glass breakage claims.

-

Excess-free Keys & Locks

We’ll pay up to $1,000 if your keys are lost, stolen or copied with no excess.

-

Hidden Gradual Damage

$3,000 for gradual water damage from a hidden water or waste pipe.

-

Excess-free Blocked Pipe

Up to $500 to unblock underground water or sewage pipes, with no excess.

-

Inflation Protection

We’ll pay up to 10% over your sum insured if a disaster increases building costs.

Benefits of our optional add-on Contents cover

-

New-for-Old Replacement

Majority of contents are repaired or replaced to new condition, not depreciated.

-

Contents in Transit or Temporarily in Storage

Store contents temporarily away from home, in transit to a new house, or stored at vault.

-

One Excess per event

If both your house & contents are damaged (e.g. flood), you’ll only pay one excess.

-

Personal Liability

Up to $1m for damage you accidentally cause to other’s property in New Zealand.

How does initio compare?

We’ve done the hard yards so you don’t have to. See how our cover compares against other New Zealand insurers.

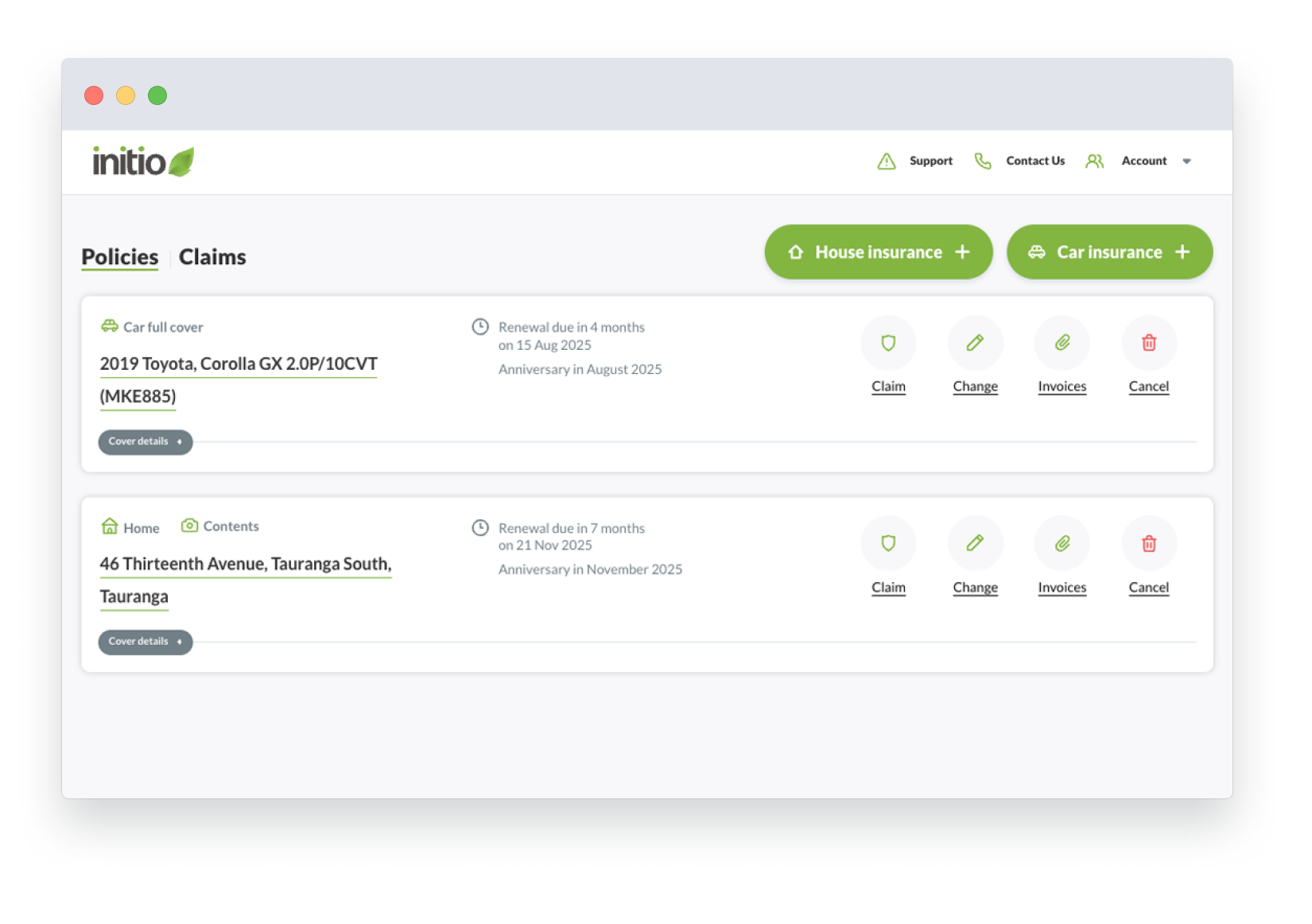

Take control with the Initio Dashboard

-

Manage your house insurance online

Every customer gets access to their own personalised dashboard login.

-

No more lengthy phone calls

Change your policy, lodge claims, add and cancel policies or get documents all online from your smart device or computer.

Useful Tools

House Rebuild Calculator

Not sure what it would cost to fully rebuild your house if it was completely destroyed?

Get an estimate quickly and easily with the Cordell Sum Sure Calculator.

Contents Calculator

Not sure what all the belongings in your house are worth?

Break down your contents room by room with our custom contents calculator.

How are contents claims paid out?

Our policy is New-for-Old based cover, where most items are covered for brand new replacement.

New Repair or Replacement

Item is replaced or repaired to new condition.

You lost your iPhone 12. $2,000 is paid for a brand new replacement iPhone 12.

Present Value Repair or Replacement

Item is replaced or repaired to current value.

You lost your iPhone 12. Depreciated $1,000 is paid based on its second-hand value.

What is covered by contents insurance?

You can choose to include contents cover with your house policy (we don’t currently offer contents insurance as a stand-alone product). Here are some things that will be covered by your contents insurance with initio:

-

Household Goods and Personal Items

Smartphone, Engagement Ring, Tennis Racket & TV etc.

-

Watersports Equipment

Surfboards, Kayaks, Dinghies & Portable Pools etc.

-

Mobility Devices & Garden Appliances

Ride-on Lawnmower, Golf Cart, Wheelchairs etc.

-

Loose Floor Coverings

Place Mats, Lounge Rug etc.

Why initio?

We use our technology to save you time and money.

Great Cover

We don't expect you to build your own policy, so we include the things that matter — bells and whistles too.

100% Online

We provide instant, online quotes for your house, and take the same approach to claims.

Support Focused

We're here to support you when tragedy strikes. Let us show you the way to better insurance.

You’re in safe hands

If disaster strikes, you’re in safe hands. Initio policies are underwritten by IAG New Zealand Ltd. Standard & Poor’s has given IAG a AA ‘Very Strong’ Financial Strength Rating.

Learn more about IAG’s financial strength rating

Common questions about house & contents insurance

You’ll need to choose a sum insured that’s enough to fully demolish and rebuild your house to its existing size (at today’s building costs).

If you’re unsure what the rebuild costs would be, we recommend you use the Cordell SumSure Calculator to help you get an estimate.

See here for our full guide on choosing your sum insured.

Visit our guide on how to switch your policy to initio.

First, make sure your new initio policy is in place. We let you place cover any day up to a month in advance.

You’ll then need to contact your insurance company and tell them to cancel your policy from the same date.

Don’t worry about getting the exact square metre size, because we only ask for an estimate.

We’ll pay to fully rebuild your house to its existing size, up to the sum insured you select. If your house suffers a total loss we’ll be able to use past records to find its exact size.

Therefore an estimate of the size is enough, while selecting an adequate sum insured is more important.

Our contents policy has limits on certain items such as jewellery and bicycles. You will need to specify items that are worth more than their limits to have full cover. To get the full list of items and their limits, see here.

You don’t need to specify other high values items such as laptops or furniture. These are automatically covered as part of the contents sum insured you select.

When you insure your house with Initio we instantly email a copy of the certificate to your email inbox. No delays — we use technology to save you time and money.

You can generate and amend the insurance certificate yourself at any time through your initio dashboard login.

Having a security camera or burglar alarm is a great way to enhance the security of your home. However, we don’t offer a discount on contents insurance for these features. Our policies are already designed to provide competitive pricing while ensuring comprehensive coverage for your belongings.

No. Initio doesn’t currently have a stand-alone contents product. We are only able to offer contents insurance as a policy add-on for the same address as the insured property. If you are currently renting a home and only need to insure your contents by itself, we’re sorry, but we don’t have an option for you at this time.

If you cancel a home policy with initio that includes the contents, then both the home and contents will be terminated from the chosen cancellation date. If you then insure a new home with initio, you can again include contents with the new home.

If you need just a little more information before making your purchase, we have plenty of helpful support articles at your fingertips. We’ve also written the five key fundamentals of house insurance, covering everything you need to consider when choosing a new policy.

When you insure your contents with us as an add-on to our Own home (owner occupied) policy, we can look to provide cover for contents temporarily in storage. Reach our to our support team to enable the cover.