The cost of owning a house is on the rise

But it’s not all doom and gloom.

Homeowners and Landlords are facing significant financial pressure in 2023.

The increase in mortgage rates, combined with rising property insurance costs, has put a strain on homeowners cash flow and the budgets of landlords, who are facing increased costs without a corresponding increase in rental income.

In addition, over the last couple of years tax changes have meant that landlords who don’t own new builds can no longer fully deduct the cost of interest as part of their annual tax return. So it’s a double whammy when it comes to interest rates; pay more, less tax relief.

As well as mortgage interest and council rates, a major expenditure item for homeowners is insurance. This article looks at house insurance costs, where they are heading, average cost per region, and what you can do to keep yours at bay.

Why are insurance costs rising?

Build costs:

The significant increase in construction costs over the last 3 years has meant that landlords (and homeowners alike) need to increase the insured value of their homes if they are to remain fully covered.

Regulatory changes:

Contrary to popular belief, a house insurance policy does not provide cover for land damage (e.g landslides), and the cost of repairing a house damaged by an earthquake is funded (to a certain level) by the Government through the New Zealand Earthquake Commission (EQC)

In October 2022 the EQC increased their levy. For most houses this is an increase of over $200. This levy is included in the insurance bill you receive from your house insurer.

Learn more about how EQC cover works

Reinsurance:

This is the insurance that insurers buy so that they can pay claims in a major event. For example if an event, such as a flood, causes losses to an insurer that exceed a certain amount, e.g. $20m, then the reinsurers pick up the tab after that.

Insurers in New Zealand are required by the Reserve Bank to carry enough capital reserves or reinsurance to pay all claims arising from a 1 in 1000 year natural hazard or weather event. This is an incredibly significant event. To put it in perspective the Auckland 2023 floods were a 1 in 200 year event.

In most other countries the requirement for insurers is 1 in 250 years, meaning that New Zealand has the highest threshold for cover imposed on its insurers compared to anywhere in the world.

This high level of cover costs insurers a lot of money, and they pass this cost onto individual homeowners.

Location of property:

The location of your property has a major influence on premium.

For example, Wellington properties are notably more expensive to insure (with insurance cover increasingly difficult to obtain). The seismic risk in Wellington, and other parts of NZ, mean that it is a lot more expensive to insure in Wellington compared to much safer areas such as Dunedin and Hamilton.

Insurers are also starting to use premium modelling called ‘risk-based pricing’. What this means is that instead of a cross-subsidisation approach, the insurer will charge a premium for a house that is directly related to the risk of that house. Traditionally insurance has been a ‘premium pool’ based approach where the many pay into the pool to help the few that need to claim – but this approach lacks fairness given that homeowners in lower-risk areas start to subsidise those that claim a lot more due to seismic risk or adverse weather. The risk-based pricing approach has its own shortcomings as it means that for some people, e.g. coastal properties, the house insurance premium becomes so high that it is not affordable.

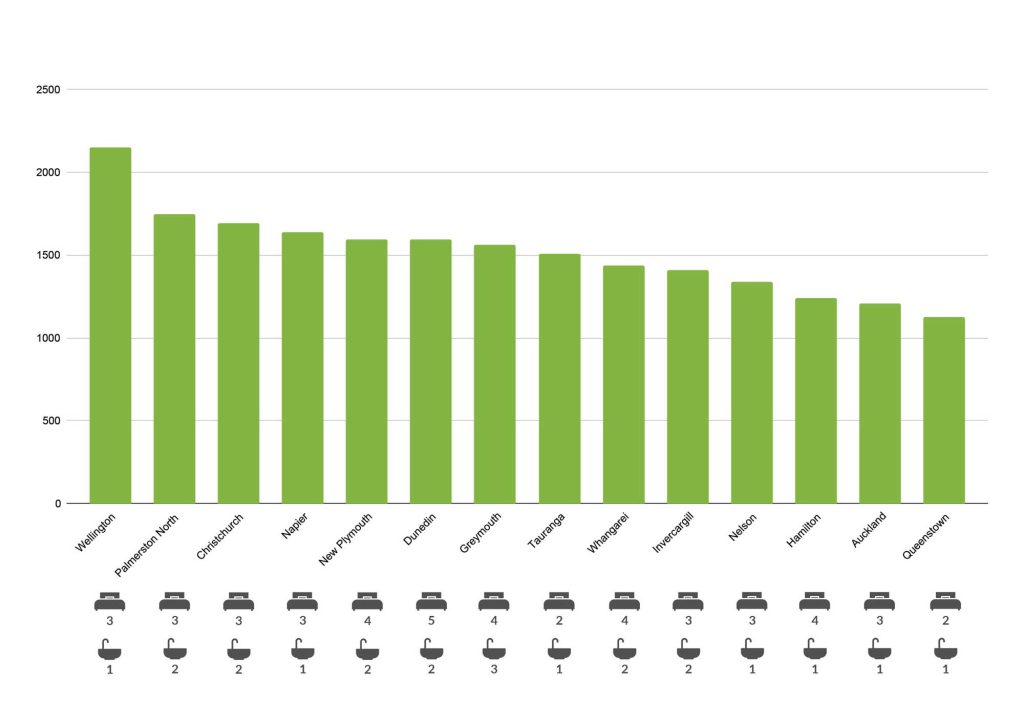

This graph provides a snapshot of the average premiums across different regions (without pure risk-based pricing):

The above graph is based on Feb 2023 homes.co.nz insurance cost estimates (powered by Initio) – for properties valued between $695,000 – $710,000. Insurance cost (incl gst) is based on an excess of $650 and does not include contents.

Attention to age of the house:

Some insurers are paying more attention to the age of the home to calculate its insurance premium. Houses built in the 1980’s for example are attracting higher premium loading due to issues with the plumbing of the era.

Similarly, houses built before 1940 are now considered ‘older homes’ by most insurers, and as well as additional requirements on the homeowner to verify that the roofing, plumbing and wiring have been replaced or are in good condition, the cost of insurance is higher than houses built post the 1940 decade.

By large newer homes (post 2010) attract the lowest premium for age.

Increase in the frequency and severity of weather events:

The average number of significant weather events for the decade ending 2020 was 9.7 per year. In 2021-22 there were 21. So far in 2023 we have seen 3 significant weather events.

More floods, cyclones and natural disaster events lead to more damage, and the majority of the repair and rebuild costs are borne by insurers. In simple terms, an insurer wants to make sure that its costs do not exceed its premium income. The single biggest cost to an insurer is what it spends on responding to and paying for insurance claims, but things like reinsurance (discussed above) and operating costs (staff, compliance costs etc) are also major expenses.

Increases in claims, at a macro level, put significant pressure on the premiums charged to homeowners, and because recent years have seen a large increase in claims, house insurance premiums have been adversely affected.

Here’s the good news! There are ways you can combat rising insurance costs.

Homeowners and landlords can adopt some strategies to help control their rising insurance costs, and also help prevent damage from occurring in the first place, as let’s face it, whether insured or not, no homeowner wants to deal with damage or loss:

Pay annually: For most home insurance, if you pay your premium annually it will be cheaper than the annualised equivalent of paying monthly.

Increase excess: The higher the excess the lower the premium. Insurers are now offering excesses as high as $2,000. This means that you will have to contribute $2,000 every time you have a claim. If you don’t claim often and you can sustain a higher excess then this is a good way of reducing your insurance costs.

Combine policies: Purchasing policies like house and personal contents together will often help reduce the overall premium, as combined to buying these policies separately.

Shop around for the best deals: Shopping around for insurance coverage can help ensure you are getting the best deal. There are comparison tools available to help you compare policies from multiple insurance providers. Remember that cheapest is not always best, so it pays to check what you are getting for your insurance spend.

Regular maintenance: A leading cause of water damage to the home water entering through overflowing pipes and gutters. Ensuring gutters are cleared regularly may just prevent that wet ceiling.

Electrical appliances: Powerboards or multi-plugs can cause house fires if they are old or low quality. Take the time to check these items in your homes or during a tenancy inspection.

Security: At home security is now more accessible than ever. The last few years have seen a number of connected security devices become available to homeowners. Products such as the Nest Protect Smoke Alarm not only save lives but can save houses too. Security cameras and alarms are a useful way to discourage intruders and reduce the risk of burglary.

Fire extinguishers: Too many kitchen fires could have been brought under control with the use of a simple, and low-cost, fire extinguisher. Having fire extinguishers in your home or rental property will reduce the severity of damage. It is also important to ensure everyone in the household knows where they are located and how to use them. Learn more about fire extinguishers.

Initio insurance; Quote in seconds, cover in minutes, claim in an instant.