Can I hold my tenant responsible for damage?

The answer is, it depends. There are circumstances where a tenant is considered liable, but this can be a little murky.

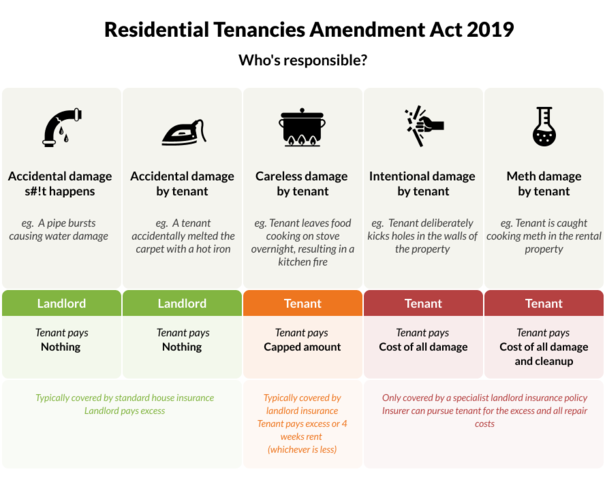

Let’s have a quick look at some key parts of the 2019 Residential Tenancies Act for insights into how you may experience it as a landlord.

Three things in the act that seem clear on paper.

1. A tenant can be held fully responsible for intentional damage

A tenant who intentionally causes damage can be held liable, and the landlord can ask them to pay for the damage. This seems like common sense.

If the landlord has insurance cover for deliberate damage, they can lodge a claim with their insurance company. The insurer will pay for repairs, and try to recover the costs from the tenant later down the track (if it’s possible).

2. A tenant can be held partially responsible for careless damage

If a tenant has ‘carelessly’ caused damage they can be held responsible, but only up to a maximum of the landlord’s insurance excess, or four weeks of rent (whichever is less).

But what is considered careless? We’ll get to that shortly.

In this case, the tenant can share in with the benefits of the landlord’s insurance cover.

3. A tenant cannot be held responsible for accidental damage

If a tenant accidentally causes damage the act considers that sometimes; these things just happen, and the damage is the landlord’s responsibility.

However, this falls into the same problem. It’s often not crystal-clear whether damage is ‘careless’ or ‘accidental’, nor is it something the landlord and tenant may easily agree on.

Many things that would ‘sensibly’ be considered careless, have been ruled by the Tenancy Tribunal as accidental – such as knocking over and leaving a hot iron to melt into the carpet.

So it’s a good idea to read through some recent Tribunal decisions – this may be helpful for future tenant discussions.

A case of melted carpet

The 2019 changes to the act are still relatively fresh and we could still see its interpretation change. This 2020 example gives an indication of the Tribunal’s approach to the difference between careless and accidental damage.

Braziers v Guttman 2020

A landlord (Braziers) took their tenant (Guttmann) to the Tenancy Tribunal to recover damage.

The landlord alleged a patch of carpet was melted, and claimed the cost of carpet replacement from the tenant for $772. The tenant admitted the carpet was melted when they accidentally knocked over a hot clothes iron.

To avoid any liability the tenant needed to prove that they didn’t carelessly or intentionally cause the damage, and that it was a reasonable accident.

The tribunal decided the carpet damage was accidental in nature, and did not have enough ‘careless’ elements to render otherwise. There was no liability against the tenant for repair costs or excess, and the landlord would need to pay for the repairs themselves, or through their insurance (and pay the excess).

Full details of the case: Braziers Ltd v Guttmann [2020] TT 4251455

Accidental Tenant Damage vs Careless Tenant Damage

As we’ve mentioned, the Act’s definition of the difference between accidental and careless damage could be better, and we are now seeing the results of this coming through the Tenancy Tribunal process. Here’s our overview:

Accidental damage is something caused by the tenant, but outside their control (for example, tripping and putting a knee through a wall).

Careless damage is caused through lack of attention or concern for the consequences (for example, leaving a stove on while you go to do something else).

But ultimately these guidelines will be up for subjective judgement. We expect to see more disagreements between tenants and landlords over who’s liable for damage. If you’re a landlord that’s applying to the Tenancy Tribunal to see what they think, you should be prepared to prove that damage was caused intentionally – or at least carelessly to avoid paying an excess.

What’s our position on all this?

We believe a clearer division between what is accidental and careless tenant damage is needed. If no clear interpretation can be made then ideally all tenant damage – whether careless or accidental – should be treated as the responsibility of the tenant (up to the smaller of the excess or four weeks rent).

This will save a lot of time and arguments. However, based on recent cases the Tenancy Tribunal doesn’t quite see it the same way.

Why can’t the tenant use their own insurance to pay for the damage?

That’s a good question.

In the past tenants were considered completely responsible. If the tenant had their own contents insurance the landlord could rely on this to pay for damage by the tenant. Almost all contents insurance policies will include the tenant’s liability to at least $1 million for accidental damage.

For many landlords, confirmation of contents cover became a condition of tenancy; if the tenant accidentally burnt the house down, the landlord’s insurance company could get the money back from the tenant’s insurance company.

Then a couple of big things happened.

1) Court of Appeal decision on Holla v Osaki

This landmark ruling established that landlords and their insurance companies could no longer recover the costs of damage from tenants. In this case, it was $216,000 worth of damage caused by the careless action of the tenant leaving an unattended pot cooking on the stove.

2) Residential Tenancies Act 2019

This act reversed the effects of the Holla vs Osaki decision and brought back some responsibility for tenants who cause careless damage. Responsibility, however, was limited to the lesser of the landlord’s insurance excess or four weeks rent.

It established that the tenant is fully responsible for intentional damage and that the tenant cannot rely on the landlord insurance policy for this. Remember that; as you would expect, a tenant’s contents insurance won’t provide cover for damage that’s intentionally caused.