Why has my home premium changed?

What makes up your insurance cost?

Your home insurance cost is made up of three things:

The Insurer Premium

This is the main part of your insurance cost. It reflects the level of risk associated with your home and a few key factors, including (but not limited to):

-

Your sum insured (the amount your home is covered for)

-

The location of the property

-

Your chosen policy excess

-

Global insurance costs (reinsurance)

-

Current construction costs for materials and labour, which influence typical claim costs

-

The frequency and severity of past or expected weather events

The Fire and Emergency NZ Levy

The Fire & Emergency NZ Levy is a Government charge that funds emergency response and firefighting services.

The Natural Hazard Insurance Levy

Previously known as the Earthquake Commission (ECQ) levy, the Natural Hazard Insurance (NHI) Levy is for a Government-provided insurance that helps with the cost of repairing or replacing residential homes that are damaged by:

-

- Earthquake

- Tsunami

- Landslip

- Volcanic eruption

- Hydrothermal activity

So right now, what’s changed, and how does it affect my insurance costs?

- Rebuild value of your home: Each year, we may raise the amount your home is insured for. We do this to account for the increasing cost of building a house, and we call it indexation. If the insured value goes up, your policy cost will also go up. Remember, you’re the one who decides the final insured value of your home. You can always change or undo any updates we make. Any changes to this value will change the cost of your insurance. Learn more about changes to rebuild values.

- Premium rate changes: Each year, the cost of your policy might change. This happens because the pool of money needed to cover claims can vary. Insurance providers, like us, look at the number of claims made and the likelihood of future events, such as storms.

- If many people make claims, for example, after bad weather, the cost for everyone can go up, even if you didn’t make a claim. The money you pay helps create a fund that covers these claims, ensuring there is enough money to cover losses when needed. So, if there are more claims, the cost could increase for everyone.

- Fire and Emergency NZ levy change: From 1 July 2024, the FENZ levy rate will increase by 12.7%. Being a change from 10.60c per $100 sum insured (capped at $119.50 per house/living unit, and $21.20 for contents) to 11.95c per $100 sum insured (capped at $119.50 per house/living unit, and $23.90 for contents)

- Average Claims Costs: The average cost of each claim has increased in line with local materials and trade costs.

- Earthquake risks: New Zealand is earthquake-prone, it’s in the ‘ring of fire’, and is considered one of the highest quake-risk countries in the world. This affects premium rates, and reinsurers (the insurers of the insurers) charge more.

- Global insurance costs: It’s not just disasters in New Zealand that affect our premium rates. When something happens on the other side of the world, it impacts the reinsurers that provide cover to the New Zealand market

- Reserve Bank risk charge: Since its 2020 review, the Reserve Bank has applied an extremely high catastrophe risk charge to New Zealand insurers. Most insurers globally have to hold sufficient re-insurance or capital reserves to cover the risk of a 1-200 year catastrophe event. New Zealand insurers have to hold sufficient re-insurance or capital reserves for a 1-in-1000 year catastrophe event.

- 2023 Weather events: Big storms and floods mean more people need help from insurance, pushing up the cost. The quantity and severity have been steadily increasing over the last few years, with 2023 being off the chart. These events tend to have a longer-lasting impact on the amount and cost of re-insurance. As a result, the effects can take longer to reach the local market.

To ensure you have the latest updates on weather events, we’ll regularly update our blog with a link to the IAG Wild Weather Tracker report.

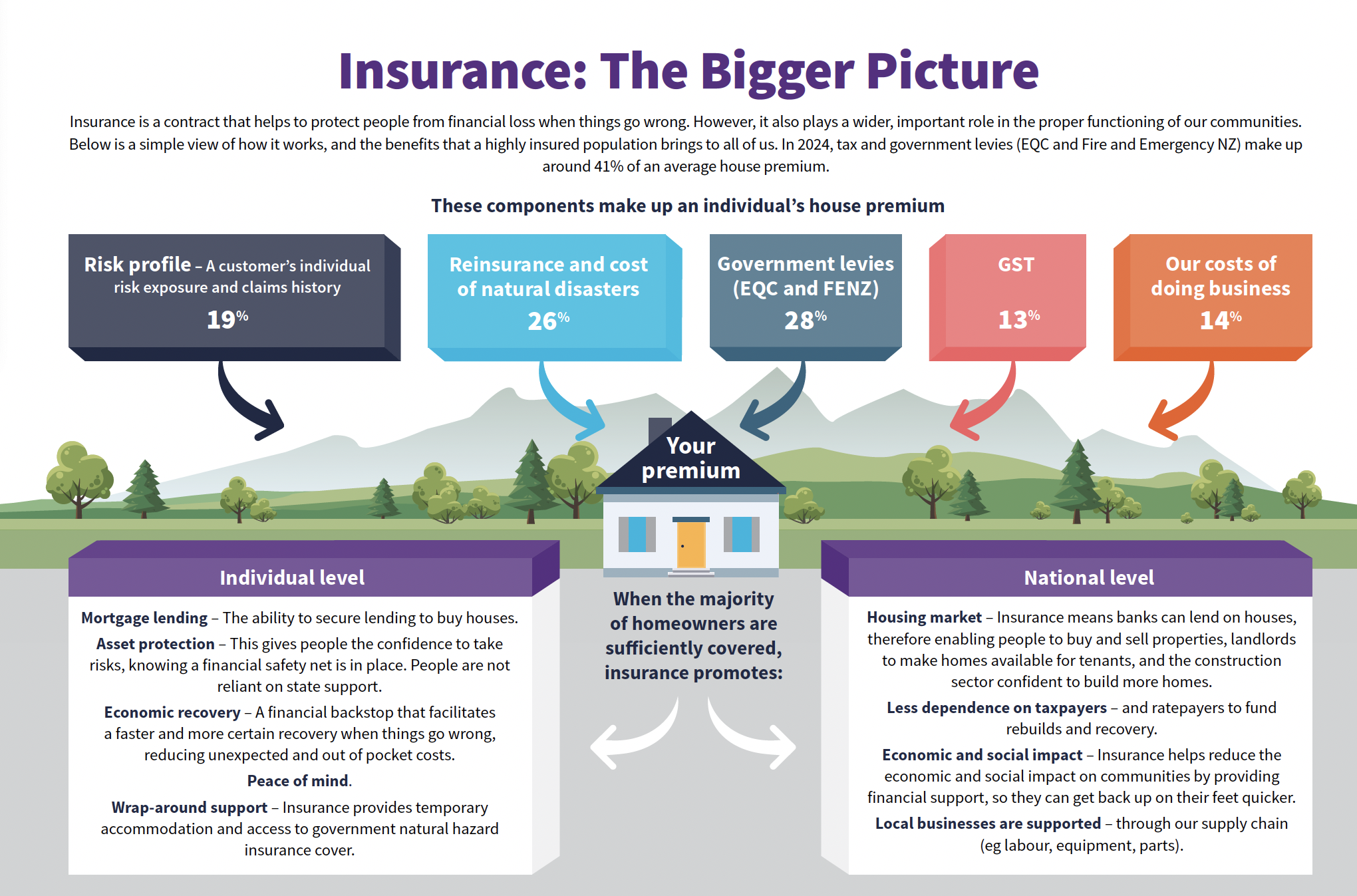

The graphic below, provided by IAG, provides more detail on the average New Zealand house insurance premium. Most of the recent premium increases are the consequence of the 2023 major weather events, reinsurance changes (insurance of the insurer) and increases in government levies:

Will I always be notified of changes?

Yes, you will. If there’s a change to your yearly or monthly insurance cost, we’ll let you know a month in advance. Generally speaking, your insurance cost will change each year.

Remember, you can also check your cover and make instant changes to things like excess and sum insured from your online dashboard.

We also display on your dashboard if there have been changes to your premium rates for any expiring policy, along with a visual cost breakdown specific to your policy. You can find that immediately above any “renew & confirm button” on your dashboard.

We aim to keep you in the loop so there are no surprises.

No. Your premium won’t change just because you make a claim. Our home and contents policies don’t include a “no claims bonus” or discount, so your premium is not directly affected by your claims history.

Useful Links

How are house insurance premiums calculated?

Am I covered for natural disasters?

Why does my rebuild value change?

Top 4 mistakes people make when insuring their house

Why do Premiums Increase?

How to set up an account with a visa debit card