How do I buy my first policy?

Wondering how to get your first policy with initio started? This guide outlines the entire process from getting a quote to paying for your policy.

It takes you through the basic steps of quoting, customising and changing your cover, disclosing other information and making payment.

Once you have purchased your first policy with initio, you get access to a personal dashboard where you can modify and manage all your policies online.

Get an instant quote – enter property address

If your address doesn’t come up with the details you have entered, please use the blue option below the address box that then comes up showing as “I can’t find my address”. Clicking on that option will let you enter both the house number and street manually.

If your home is a new build in a particularly new street, potentially our database may not be able to locate the street, if so, please give our team a call to obtain a quote.

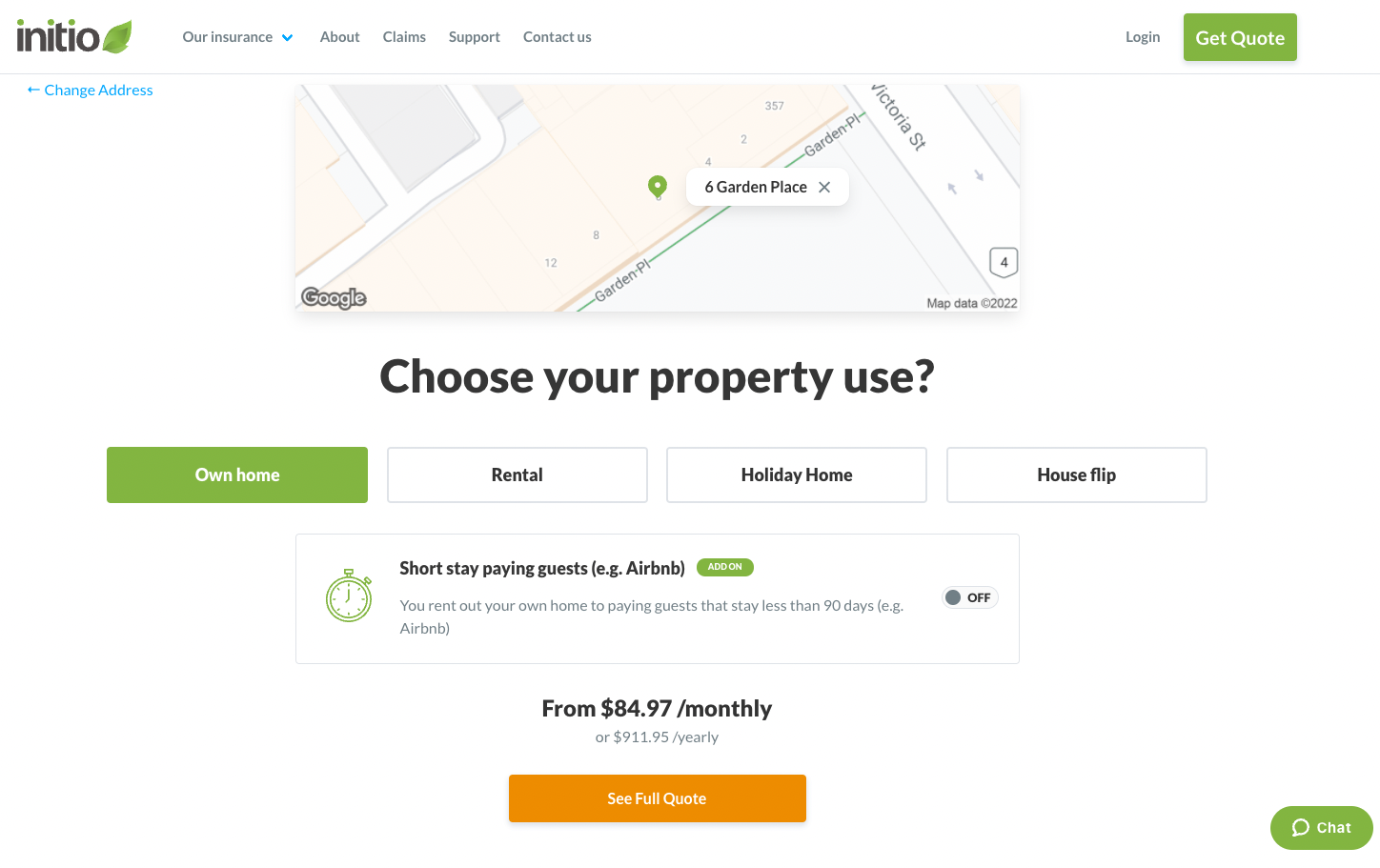

Select property use

If you’re uncertain about the type of property insurance that best suits your needs, visit our ‘Choosing Your Insurance‘ support page. There, you’ll find detailed information and guidance to help you make an informed decision tailored to your unique circumstances.

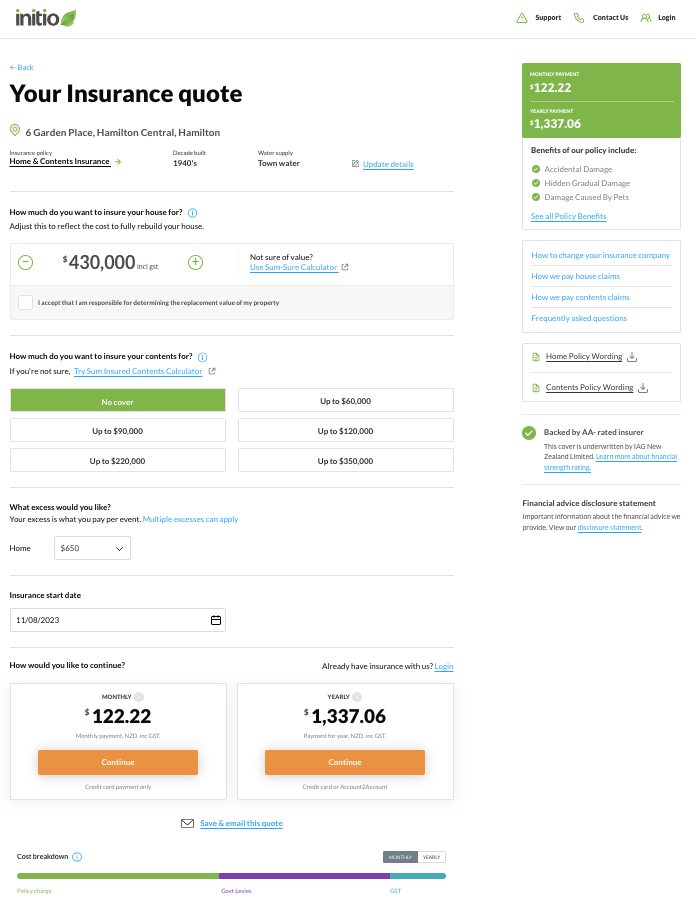

Customise quote

From here you can edit the details of the quote and customise as required. This can also be done from a home quote you have previously emailed yourself using the “restore” button.

Uncertain about the proper amount to insure your property for? We’ve designed a support page that walks you through the essential factors you need to consider regarding the sum insured.

Choosing the right amount of insurance for rebuilding your home is important. This amount should be what it costs to build your home again, not what your home is worth on the market. Don’t forget to include things like fences and swimming pools, and remember that building costs might go up over time. For example, if two neighbors with the same houses insure for too little or too much, they could lose money if their houses are destroyed. The right amount saves worry and money. Tools like the Cordel Sum Sure Calculator can help you figure out how much it might cost to rebuild your house.

If you’re wondering about how much excess you should have on your insurance policy, this support page covers some of the basics. Many property owners choose to cover minor losses themselves, avoiding insurance claims for low-value damages. If this applies to you, consider raising your excess to $1,000 or $2,000 to save on premiums. Think about what you’re comfortable claiming for and your financial risk tolerance when selecting house insurance. Under initio’s landlord insurance, tenants only cover the excess on careless damage, so assess your comfort level with potential out-of-pocket expenses, and set your excess to match your ability to absorb those costs.

Insurance Start Date? Enter the date that you would like the cover to start from should you proceed with purchasing. If it’s a new home, that should represent the sale’s settlement date. If you’re changing from another insurer, use your existing expiry date. Please note that we are only able to provide confirmed quotes for policies with effective dates of up to 30 days in advance. If the effective date you need is more than 30 days ahead, please wait till you are closer to that time to quote/apply.

Once you are happy with your customised quote, you can either;

- Email yourself a copy to save a copy of the quote

- Proceed to purchase the policy by selecting either the “annual” or “monthly” payment option at the bottom of the quote. Then follow the steps below.

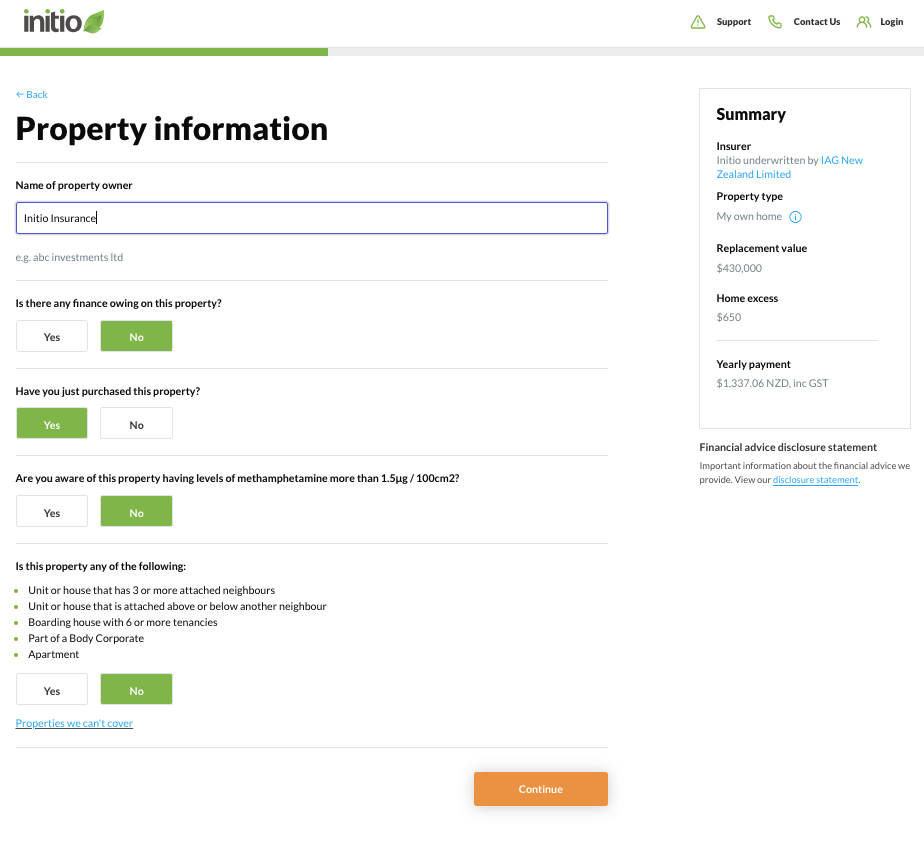

Enter property details

A note about selecting start date of cover; ensure its the same date as the expiry/renewal date of your current policy to ensure cover continuity (or the settlement date if purchasing a new house)

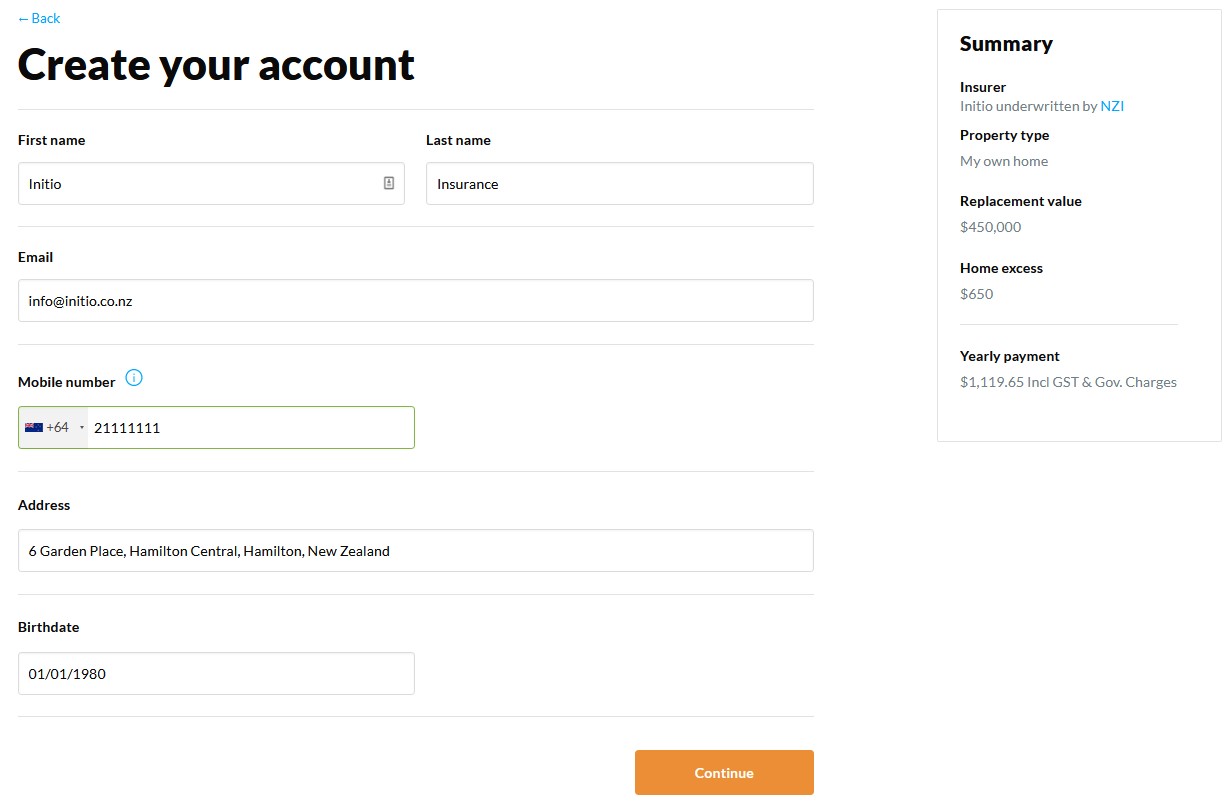

Confirm your details

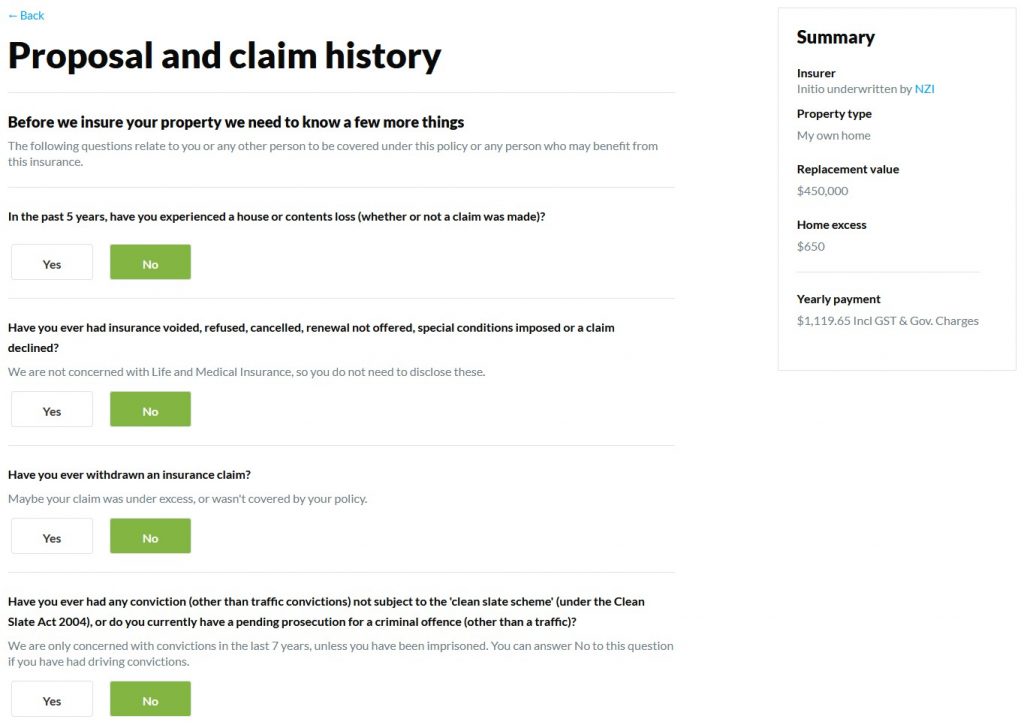

Complete online proposal form

Unsure if something may affect your cover? Disclose it

How to sign your application form

Use the device keyboard to type your name in full (as the person completing the form) in the space provided.

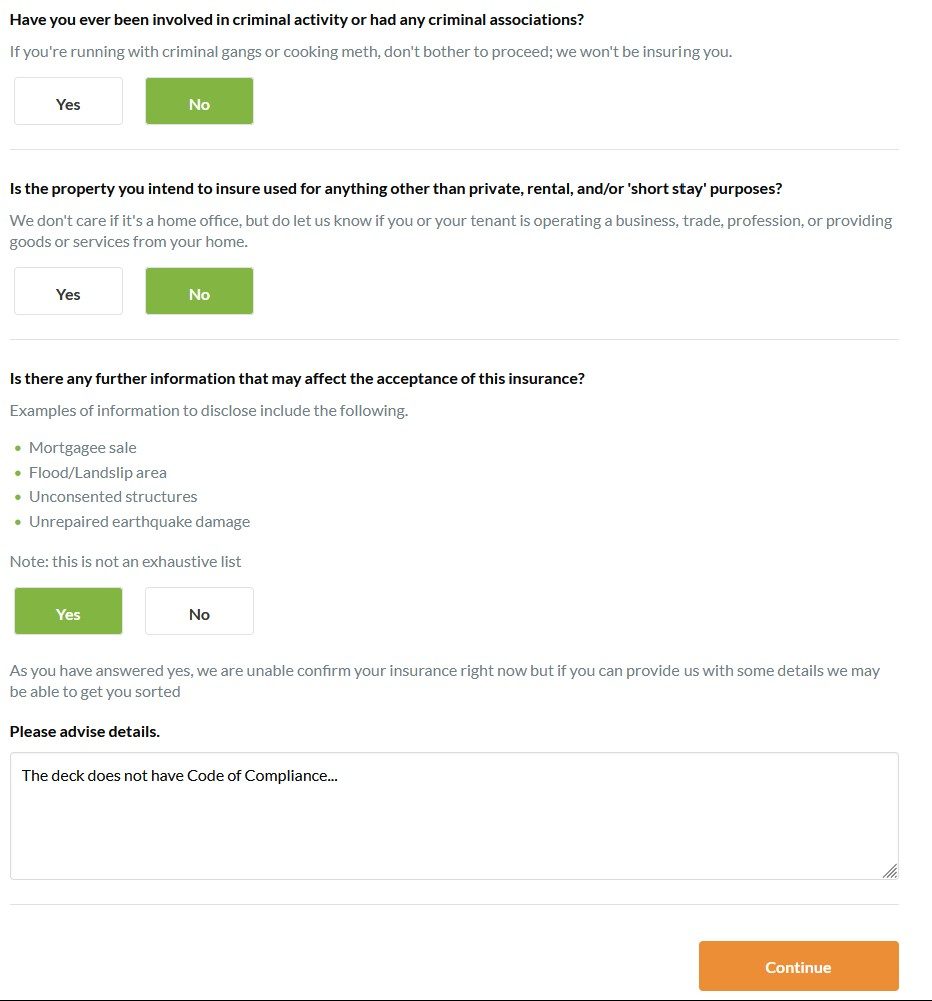

Review and make payment OR Application requires a review?

If the payment option isn’t offered it’s because a human will need to review the application for you. Please continue to submit the application for review and we will aim to come back to you within one business day to let you know the status of the request.

Otherwise, if the payment option is available, you can either

- proceed to purchase the policy OR

- if you’re not ready to commit or haven’t yet bought the property, you can choose to download a “letter of intent” on this page. The letter of intent simply outlines that based on the information provided we are able to insure the property when you’re ready.

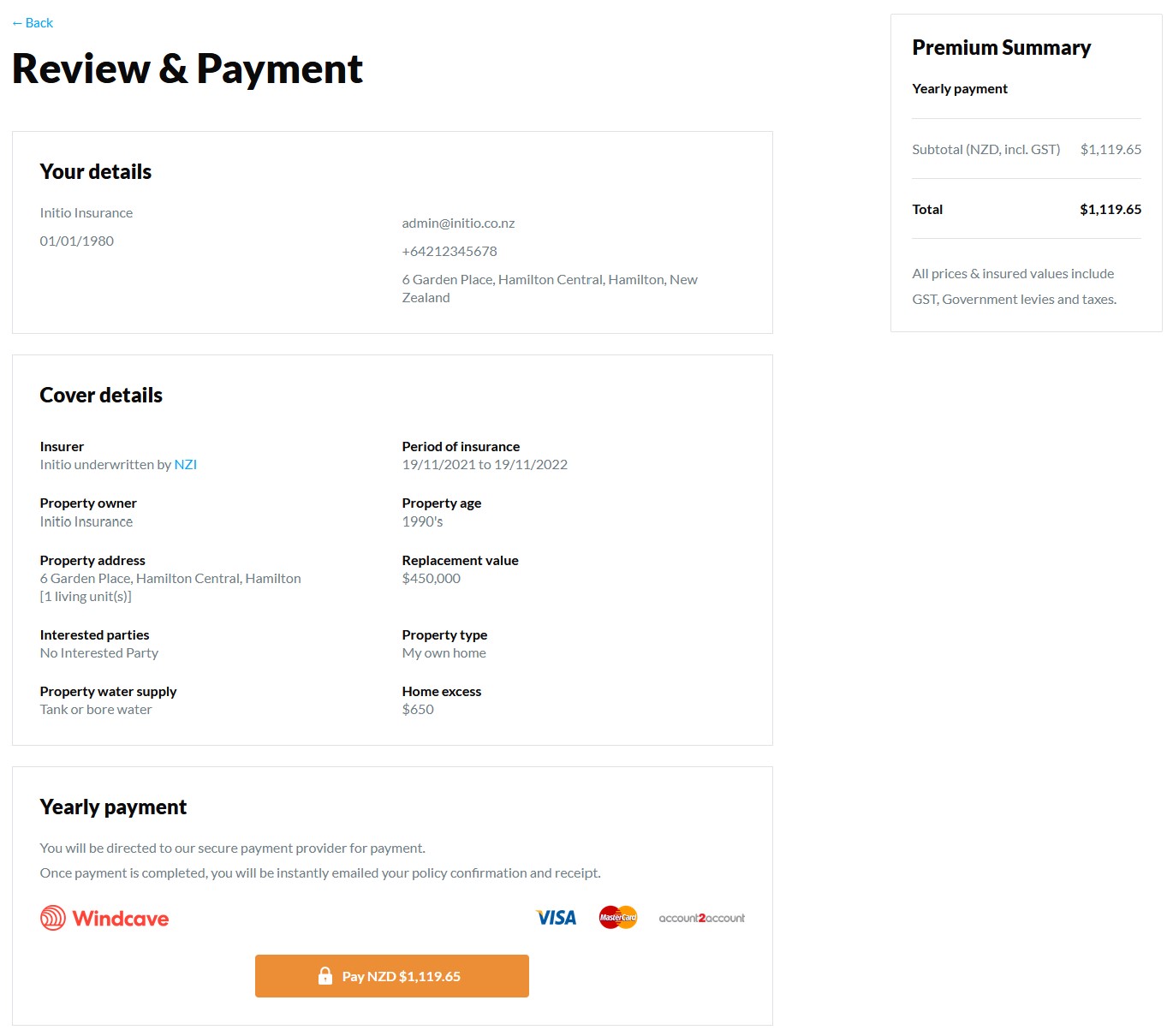

ALL DONE! We will instantly email you confirmation documents

Want to add another property? Click “Add insurance”

Need to make a change to your policy?

Refer to our guide here. Our website is informative and the go to for accessing your account. No need for an app, our site is available in a user friendly format on all your devices.

Looking for more information? Our top five mistakes to avoid when insuring property article might help.

If you would like to see how initio compares to other popular New Zealand insurance companies, start here.

Adding or changing your policy

Looking to buy a Motor Vehicle Policy?

Our vehicle insurance is exclusive to our home policy holders. Once you become a home policy holder with initio you can easily add car insurance from your initio dashboard using the “vehicle insurance +” option.

Ready to begin your journey with initio?

Useful articles