Claim trends report 2025

As 2025 comes to a close, we want to take a moment to reflect on some of the ways we’ve helped our customers this year. It’s been a year of quick claims and responsive support at initio – all driven by our core values of customer satisfaction, speed, and making insurance easy. From fast claim resolutions to lightning-quick answers on our support lines, 2025 showed what our team and technology can do to take care of you when it matters most.

Ways we’ve helped our customers with their claims

When it comes to insurance claims, we know you want a swift, clear outcome. In 2025, our claims team made sure “waiting around” was rarely part of the experience. Many claims were sorted out within just a day of being lodged – yes, some were literally resolved overnight. A large number of others were wrapped up within the first week. Nearly half of all claims were resolved within 30 days, with many settled much sooner. Our approach is all about fast assessments and clear communication, so you’re never left hanging.

Speed doesn’t mean we cut corners, even on the tough cases. Big or small, every claim got the same careful attention. We handled hundreds of claims even during the busiest periods (think wild weather weeks and the holiday rush) without breaking stride. And while most claims were everyday-sized or moderate, we also helped customers through some major events – including a few very large claims like house fires and water damage. Those high-value claims were supported just as promptly and compassionately as a cracked window or a burst pipe. Whether it was a minor accident or a serious loss, we followed the same straightforward process and kept our customers informed at each step.

Several clear patterns stood out in our 2025 claims data.

Vehicle glass claims (like damaged windscreens) made up about 12% of all claims. These are the everyday mishaps many drivers run into, and they are usually simple to assess and settle quickly.

Water damage was another common claim type, at around 10% of total claims. While it was not the biggest category by volume, it had a much bigger impact on cost, making up roughly 27% of total payouts. Problems like hidden leaks and burst pipes can get worse fast, so acting early really helps.

At the more serious end, accidental fire claims were uncommon, at about 1% of claims in 2025. But when they happened, they were often significant, accounting for around 12% of total claim costs. It’s a strong reminder that the right cover, plus a responsive claims team, matters most when something major goes wrong.

We also saw how external events can cause short, sharp spikes in claims. 29 April was our busiest claims day of the year, lining up with a bout of severe weather that brought heavy rain and strong winds to parts of the country. As you’d expect, that drove an increase in weather-related claims, with customers reaching out for support when it mattered most.

This year, we saw claims for just about everything under the sun (and rain). The most common claims by number were the ones you might expect – accidental damage around the home, car-related mishaps, and weather events. Life happens, and sometimes that means a stray cricket ball through a window, a parking-lot fender bender, or a blustery storm knocking over a fence. These everyday issues kept us busy, but that’s exactly what we’re here for.

Support when you need it

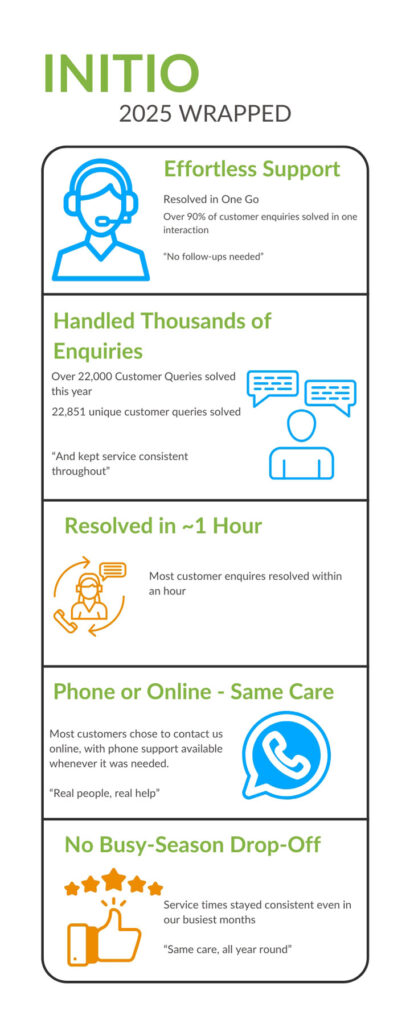

Our commitment to speedy, helpful service wasn’t just on the claims side. The initio customer support team had a standout year in 2025 as well, making it easier than ever for you to get the answers or help you need. We handled over 22,000 customer enquiries throughout the year – and we did so with an emphasis on being both quick and effective. In fact, most customer questions or issues were resolved within about an hour. A huge portion (over 90%) were solved in a single interaction, meaning one call or message was all it took to sort things out. No endless email chains, no multiple phone transfers – just one conversation and you’re sorted. “No follow-ups needed” became a bit of an unofficial motto for us this year, and we’re proud of that.

We also made sure you could reach us in whatever way suits you best. The majority of our customers chose to contact us online – whether by email, live chat, or through their initio dashboard – and they got the same friendly, professional care as if they’d called us on the phone. Of course, whenever a phone call was preferred or needed, we were right there too. Real people, real help, every time. We know sometimes you just want to hear a reassuring voice on the other end of the line, and our phone support team was ready whenever those moments came.

Chatbot Chad played a big part in that easy, quick support experience too. In 2025, Chad handled nearly 3,000 conversations and sent over 7,000 messages, helping customers get answers fast when it suited them. Chad achieved a 95% answer rate, and the vast majority of customers rated their experience with Chad highly, showing that self-serve support can still feel genuinely helpful and human.

Despite handling thousands of enquiries, we didn’t let quality slip during busy seasons. Even in our peak months, response times stayed consistently quick and our service stayed personal. We like to say we’re “built for busy days” – and in 2025, we proved it, delivering the same care and speed no matter how high the volumes got.

Looking back at these highlights, what makes us happiest is knowing each number represents a customer who got the help they needed and could move forward with peace of mind. Thank you for trusting us with your insurance in 2025 – we’re truly honored to have helped you through everything from everyday hiccups to life’s big storms. We’re excited to keep that momentum going into 2026, with even more improvements on the way to make things faster, easier, and smarter for you. From everyone at initio, we wish you a safe and happy New Year. Here’s to a bright 2026 ahead!

Related articles