Renting out two dwellings on your property long-term

If you own a property with two dwellings and rent them both out long-term (90 days or more per tenant), it’s important to have the right insurance to protect your investment. Whether the dwellings are separate or physically connected will determine the type of insurance you need.

What type of rental arrangement is this?

- Two homes, same site

- Both rented on long-term residential leases

What insurance do you need?

The right insurance depends on whether the dwellings are physically connected or separate:

If the dwellings are NOT physically connected (e.g., separate buildings on the same section):

- You’ll need two landlord insurance policies, one for each self-contained dwelling. Each policy will cover the specific rental risks of that property, including tenant-related damage, liability, and loss of rent.

Start by buying one landlord insurance policy, then add a second through your dashboard (instructions below)

If the dwellings ARE physically connected (e.g., one upstairs and one downstairs, or connected by a wall, roof, or garage):

- You can use our Multi-Unit Rental policy, which provides coverage for both units under a single policy. you’ll need to state the number of self-contained dwellings at the address. This helps ensure you get the right level of cover for your property setup.

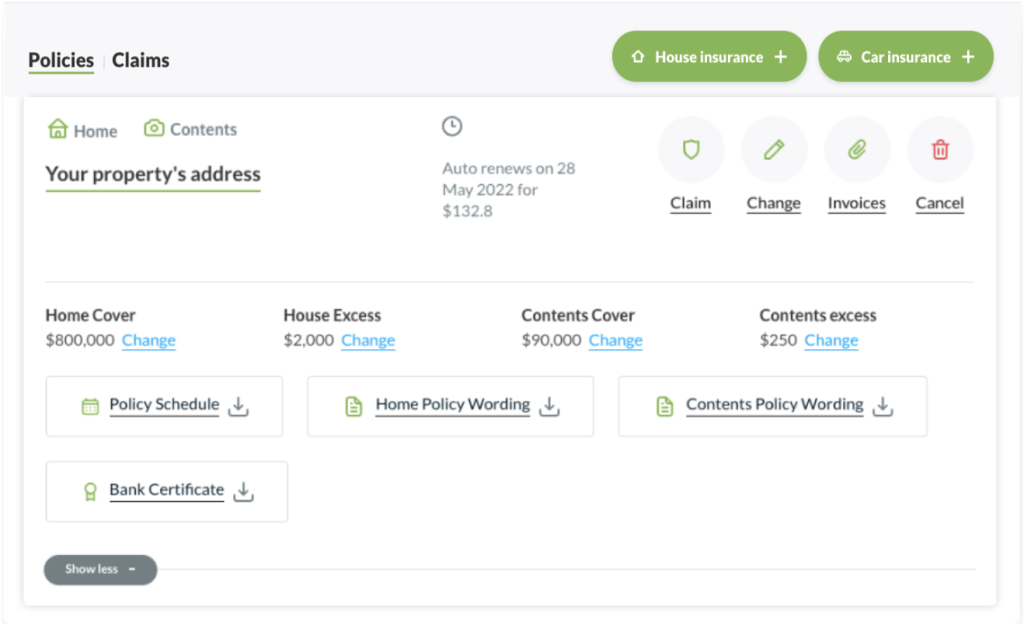

How to add a policy for a second dwelling on the same title:

-

-

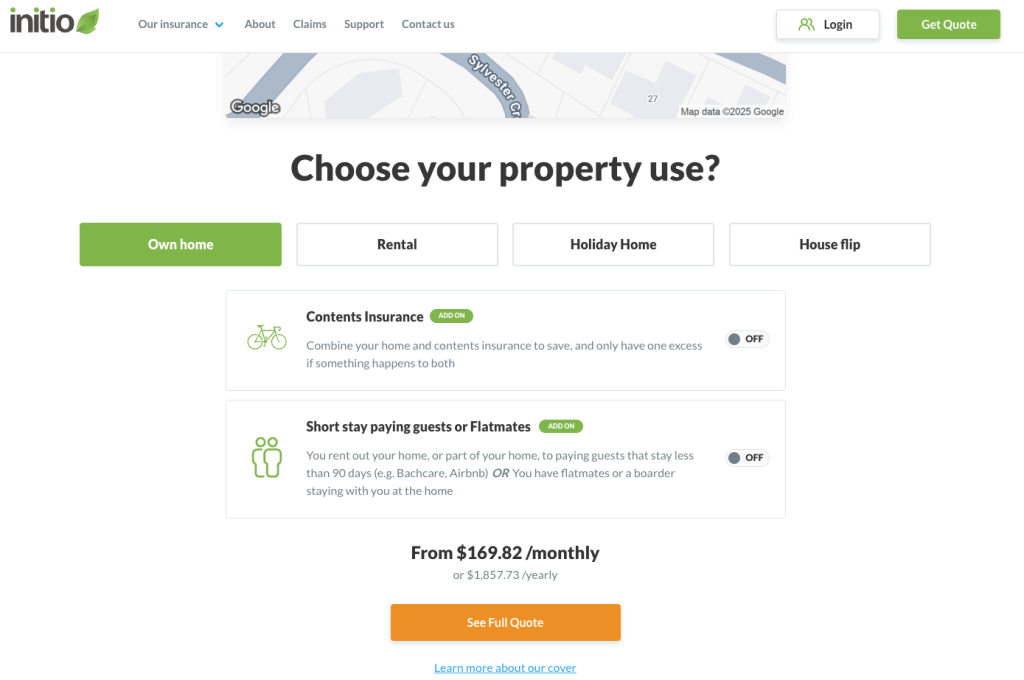

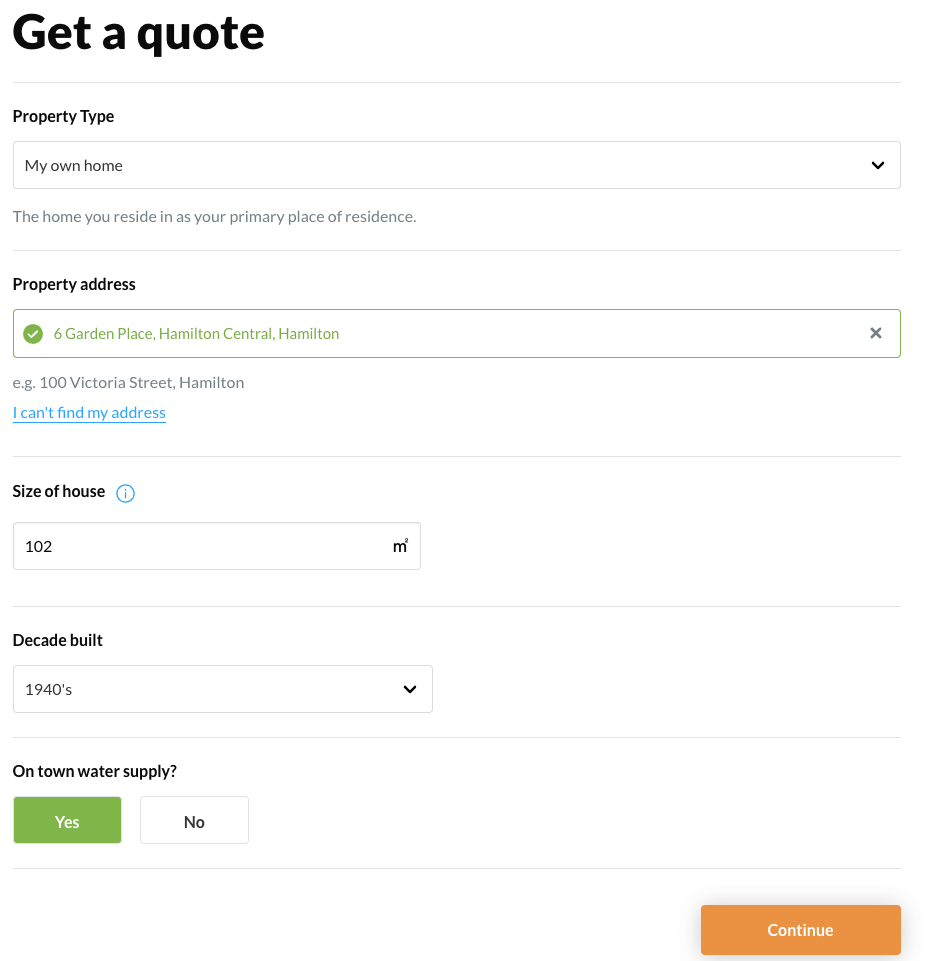

Search for your home address & ‘see full quote’

-

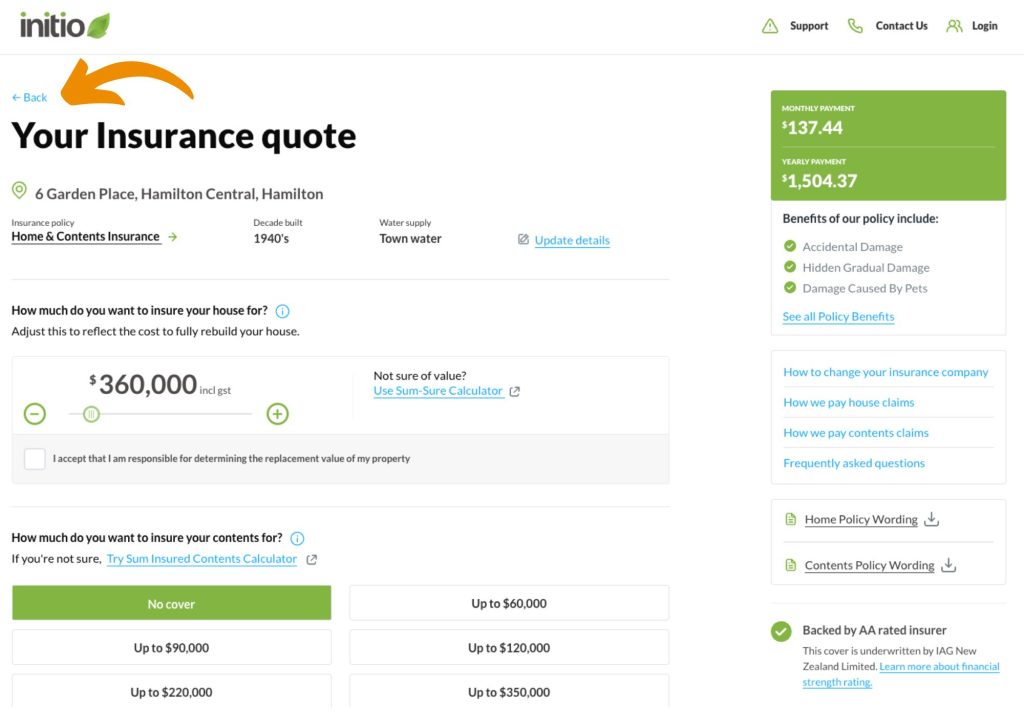

On the full quote screen, click ‘back’ to edit the second dwelling’s details if needed.

-

If both properties are the same size or the details are already correct, no changes needed.

-

-

Once you go back, edit the property details, then click ‘continue’

- This will adjust the quote to reflect the correct figures for the property.

Finish the quoting process from here per the usual process – Easy!

You can get a quick quote and buy insurance online in just a few minutes with initio. Make sure you choose the right policy based on whether your dwellings are separate or connected. Getting a quote and buying insurance online with us is easy, but our cover is anything but basic. We offer comprehensive protection to ensure you’re fully covered.

Not quite what you’re looking for? Maybe some of these other scenarios suit you better: