Smart strategies for premiums, excess and payment timing:

Smart moves, part II

In the second part of our interview with experienced investor Graeme Fowler, we unpack how insurance decisions can impact your bottom line, especially when it comes to excess, premiums, and payment timing.

How do you decide on the right excess?

“I always choose the highest excess available, usually around $2,000. That helps lower my annual premiums quite a bit. But if you’ve only got a couple of properties, a lower excess might make more sense.”

Graeme treats excess like any other business decision: it comes down to scale and risk tolerance. For those with larger portfolios, absorbing the occasional small cost can be a smarter long-term play.

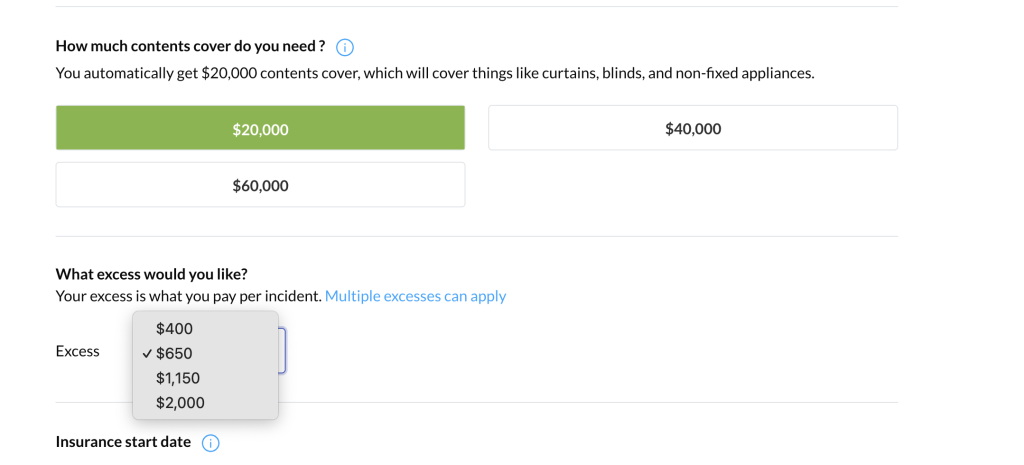

From initio: When quoting with initio, you can select an excess from as low as $400 up to $2,000. The premium updates instantly as you adjust the excess. A higher excess = lower premium, but the right choice depends on how often you expect to claim and what you can comfortably afford to self-fund. Learn more about insurance excess: Demystifying Insurance Excess

What’s your take on how to pay for insurance?

“I always pay annually. Monthly payments might feel easier, but they usually end up costing more. Over a year, you could save quite a bit by paying in one go.”

For Graeme, annual payment isn’t just about cost – it’s also about efficiency. One payment, done and dusted.

From initio: Our quick quoting tool shows the full cost upfront, with a clear breakdown of monthly vs annual payments. Monthly might feel easier, but it comes with a life admin fee – plus, annual is usually better value. And honestly, how much is your time worth? Adjust your excess or add contents and the quote updates instantly. It’s fast, clear, and makes insurance simple.

How do you view insurance as part of your overall investment strategy?

“It’s one of those things that, if you get it right, saves you money quietly in the background. If you get it wrong – or ignore it – you’ll know about it quickly.”

Graeme treats insurance like any other portfolio tool: it should be optimised, not just set and forgotten. Managing excess, timing payments smartly, and locking in renewal rates all contribute to a more efficient portfolio.

From initio: With our digital platform, you can manage all your policies in one place – tweak cover levels, update payment settings, and renew when it suits you. We also send early renewal reminders and show any pricing changes upfront, so you can stay ahead of known levy increases.

Coming up next in the Smart Moves Series:

Common landlord insurance mistakes – and how to avoid them.

We’ve pulled together the key takeaways from this series into our Landlord Insurance Fundamentals Guide—including a bite-sized version of our interview with Graeme Fowler. It’s a great place to start if you’re after a practical overview of insurance essentials for NZ landlords. Read it here

Related support articles: