The Unpredictable World of Home Insurance

From Seagulls to Scribbles

Life can be full of surprises. This year, our clients’ experiences range from the utterly unexpected to the charmingly chaotic. We understand the need for comprehensive property insurance that covers these unforeseen events.

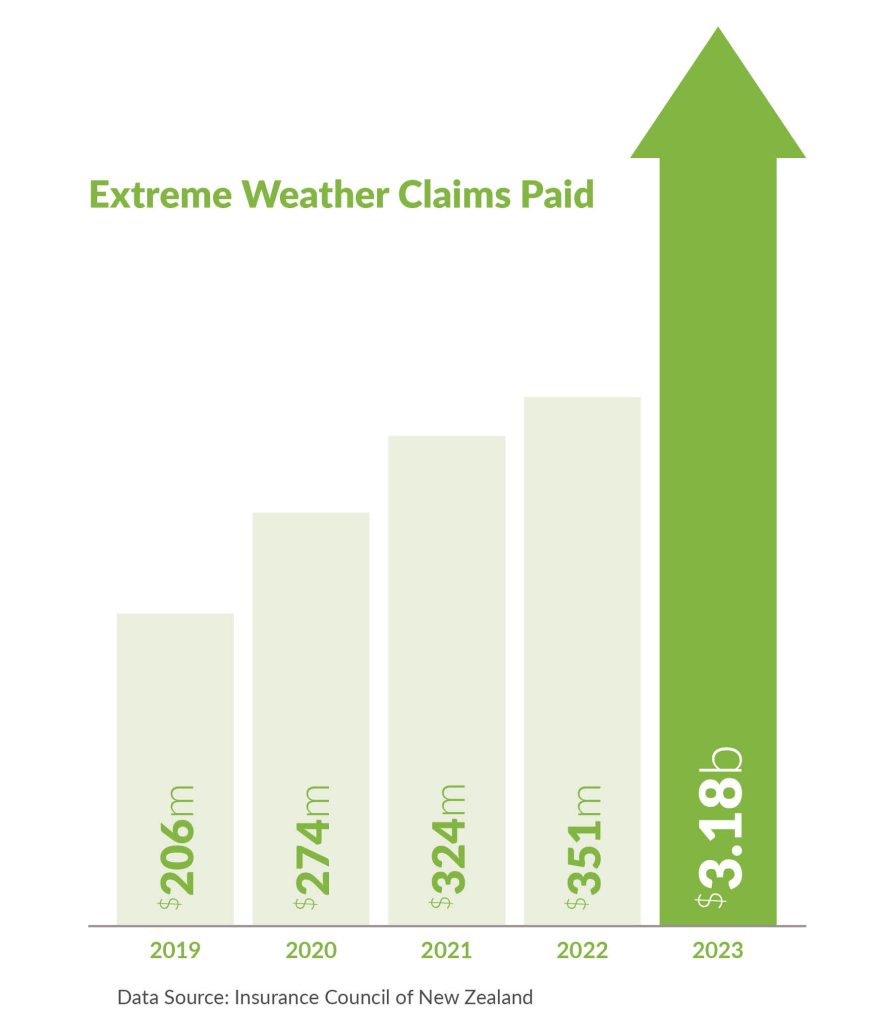

This year, initio has processed a record number of claims, almost doubling from last year. Our payouts have increased significantly by over 230%, a substantial rise compared to the 45% increase from 2021. The major storms and flooding we saw at the beginning of the year (along with other significant events) meant more people needed help from their insurance provider, which in turn pushed up the cost of insurance premiums. The intensity and frequency of these events have been steadily increasing, with 2023 being off the chart, as shown in the graph below:

It’s worth noting that the above figures are across all New Zealand insurers and were calculated in August 2023, these numbers will be even higher now.

The growing number of Kiwi homeowners choosing initio has also influenced these increased numbers. We’re delighted that many have selected us as their insurance provider, indicating our ongoing growth and success. A heartfelt thank you to those who have recently joined us and to our loyal customers who have continued with us this year.

As we wrap up the year, let’s explore the lighter side of insurance with a look at some of the most unique claim trends we’ve encountered in 2023:

Nature is wild

Nature can be unpredictable, and it certainly was for a few of our clients this year. In one instance, a drone was unexpectedly taken out by a seagull, while in another, a bird decided to make a home in a client’s chimney, causing a mess and eventually meeting an untimely end. Nature’s surprises can sometimes be costly! Domesticated pets also caused their fair share of claims this year, the majority of which were caused by them not making it outside in time to use the bathroom. These types of claims alone caused thousands of dollars worth of damage.

The artistic and the audacious: Children at play

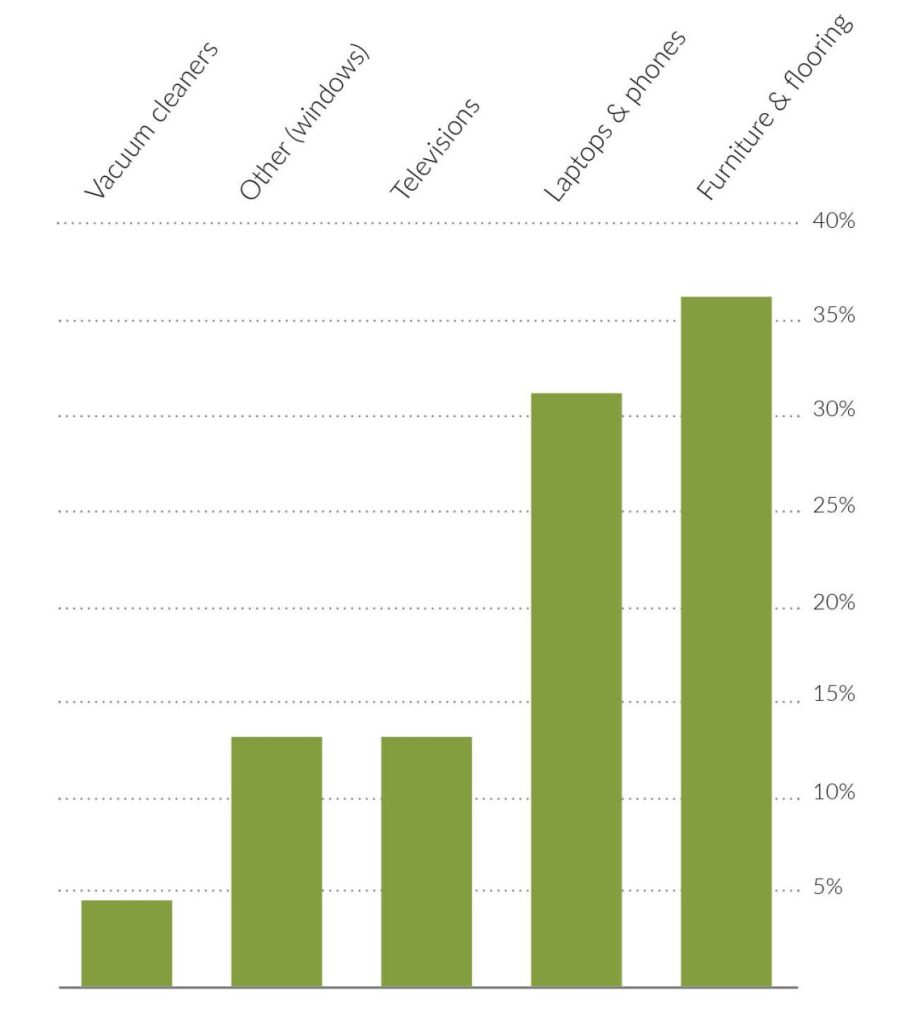

Children bring joy and, occasionally, a bit of chaos. From a child’s artistic scribblings using foundation makeup that unfortunately left lasting marks on furniture and décor, to the regrettable incident where a backpack met its fate under the blades of a lawnmower, and those inventive yet ill-fated attempts at cleaning up spills with a vacuum cleaner, the innocence and spontaneity of children can sometimes come at a cost. Not to mention the numerous TV and tech accidents involving toy hammers, building blocks and balls, all leading to thousands of dollars of damage.

Another client unexpectedly went into labour while at home, an experience filled with surprise and natural wonder. But when her water broke, it soaked the carpet in the process.

CHILDREN VS HOUSEHOLD ITEMS 2023:

Tesla tales: The perils of parking

This year, our Tesla owners have navigated various challenges, notably a rise in claims for windscreen damage and parking incidents. Even the most advanced vehicles aren’t immune to the quirks of daily life. One advantage of owning a Tesla is the reduced petrol costs, coupled with comprehensive camera coverage. This feature ensures most incidents are recorded, providing valuable evidence. It’s important to remember if you accidentally collide with a parked Tesla, chances are, it’s on camera.

Candles and pianos don’t mix

Coincidently we saw two cases of candle wax melting onto pianos this year, making them unplayable. These two incidents alone cost thousands of dollars of damage (pianos are expensive!). While they might create a beautiful ambience, the takeaway lesson would be perhaps don’t have lit candles on top of your piano.

At initio, we’ve seen it all, from feathered fiascos to technology tragedies. These stories showcase the unpredictable nature of life and the essential role of comprehensive property insurance. Whether it’s a mischievous child or a parked Tesla, we’re here to ensure that when life happens, you’re covered. Discover the ease of getting a quote and the simplicity of insuring with initio for yourself.

Percentages in this article have been rounded.