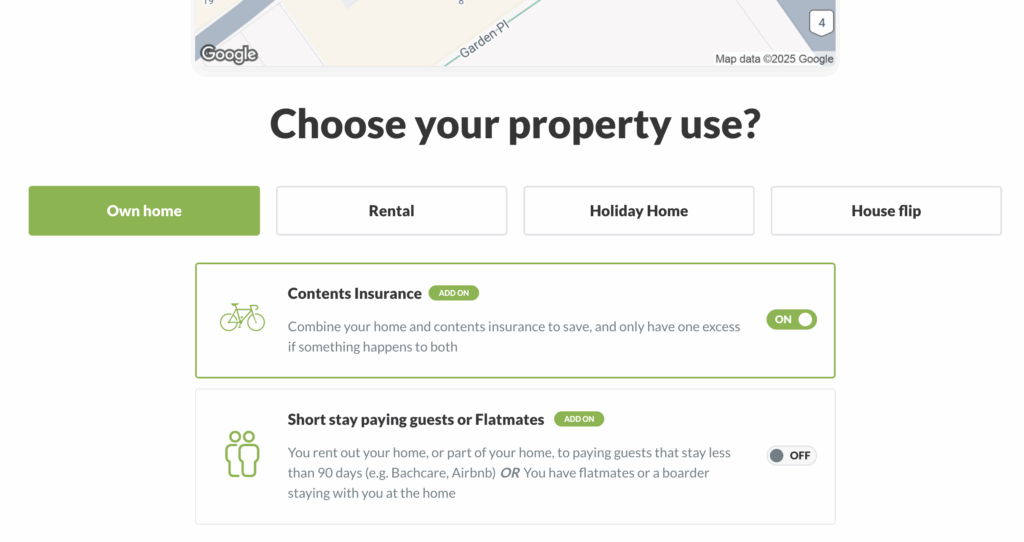

How do I add contents insurance to my policy?

Whether you’re adding house, landlord, or holiday home contents to your insurance policy, the process is straightforward. You can add contents cover when getting your insurance quote by simply toggling it on in the quick quote tool. Once you have your policy in place, you can log into your initio dashboard at any time and adjust your contents cover to suit your needs. This flexibility means you can update your cover as life changes, without needing to start a new policy.

The main differences between our contents cover options come down to what’s covered and how it’s covered.

Own home contents:

![]()

This is the broadest option, covering personal belongings kept at your home. It also extends to some items temporarily away from the house, such as personal items you might take with you around New Zealand. Cover also includes limited perils for contents in transit when you’re moving between homes.

Landlord contents:

![]()

This is limited to items you’ve provided at the rental property, such as appliances, furniture, or curtains for the tenant’s use. It doesn’t cover tenants’ belongings, as they’ll need their own contents policy. Cover is restricted to the property address and excludes things like your personal items, linen, or leisure gear or items you’ve stored at the address.

Holiday home contents:

![]()

Similar to landlord cover, this applies only to contents kept at the holiday home address. It typically includes furniture, whiteware, and general household fittings. Owner’s personal belongings, expensive hobby equipment, or anything stored off-site are not included.

Tip: If you’re unsure what your contents are worth, you can use the CoreLogic contents calculator to get a better idea before setting your cover level.

Can I get contents insurance by itself?

It’s worth noting that initio does not currently offer stand-alone contents insurance. To get contents cover, it must be added to an active insurance policy for the same property. If you only need to insure your contents, such as when you’re renting or not insuring the home itself, initio is not able to provide contents cover.

Related articles