When do you need confirmation of cover?

Before your bank approves finance for a home you are looking to purchase, they will want confirmation that you can obtain insurance for it. This ensures the security (your home) they will use for the loan can be protected.

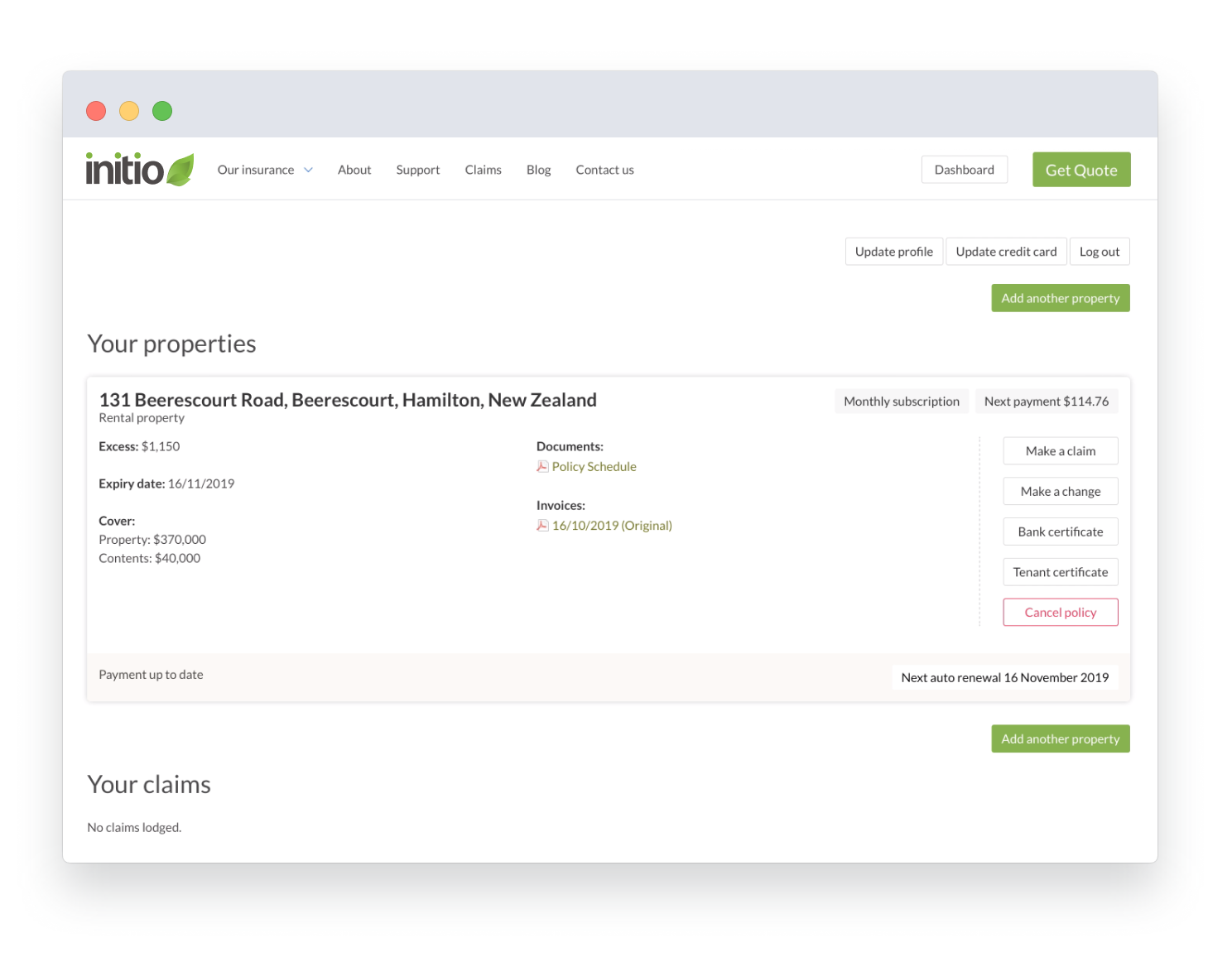

With just a few straightforward steps, you can have this document in your inbox the same day – depending on how quickly you fill out our online form!