How digital insurance makes things easier for customers

Digital only matters when it makes things easier at the moments that count.

You’ll often hear us described as a fully digital insurance provider. That’s true. But what does being digital actually mean for the people who insure with us?

For us, digital isn’t about removing people from the process. Removing the friction that gets in the way of something that should be simple is what it’s about.

Because our systems do the heavy lifting. Our support and claims teams avoid manual paperwork. They don’t have to re-enter details. They also don’t have to chase forms. Claims don’t need to be lodged through multiple phone calls. You don’t need to stitch insurance policies together by hand.

That time shifts to what truly matters when you feel overwhelmed, under pressure, or just want a clear answer.

It means we pick up the phone when you call or respond to you online in an instant.

Technology that gives time back to people

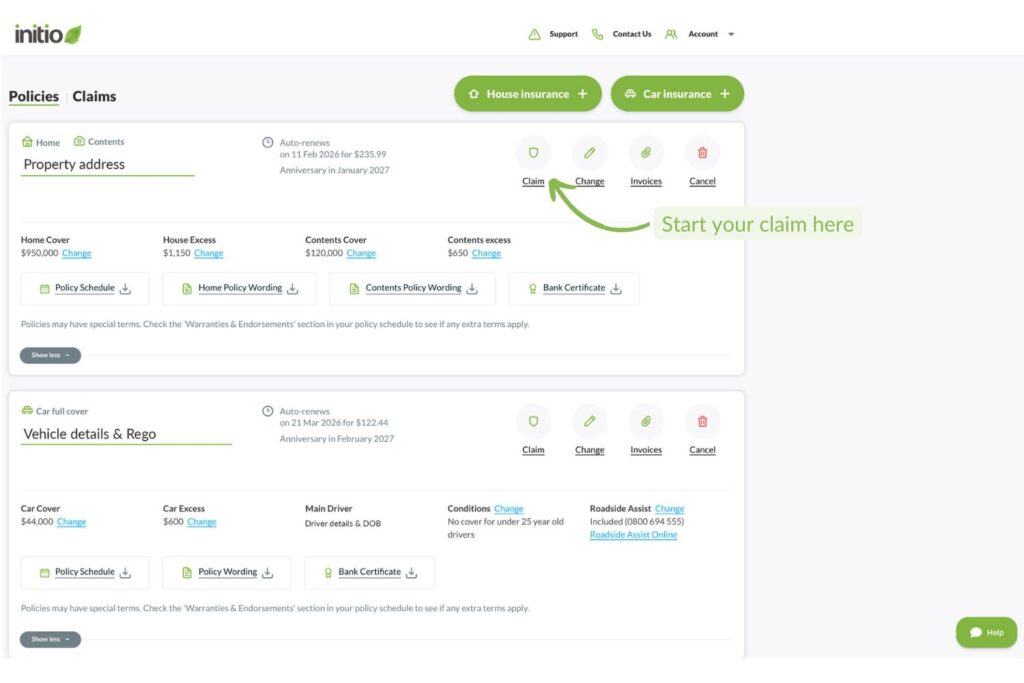

We use technology to make things faster and clearer. Things like online quotes, a customer dashboard, and a chatbot that can answer common questions at any time of day.

But here’s the key part: if our chatbot can’t give you the answer you need, it doesn’t trap you in a loop. It puts you through to a real person, straight away.

Digital tools should never be a barrier. They should be a shortcut.

That’s why we design everything we build on the technical side to give our team more time to help, not less.

People first, always

Have a look at our reviews, and you’ll see a common theme. People talk about being able to get hold of someone. About feeling listened to. About their insurance claims being handled with care.

Insurance claims can be stressful for customers, and sometimes emotions run high; not every situation is simple. But when things are stressful, the last thing you need is to be playing phone tag with your insurance provider.

Digital insurance on its own isn’t enough. Digital only works if it makes human support easier to access when you need it most.

Why this matters when things go wrong

I saw this first-hand over Christmas when a family member was involved in a car accident. Thankfully, no one was seriously hurt.

In the middle of it all there were police, ambulances, fire trucks, people from the other vehicles, and broken glass mixed with Christmas pavlova scattered throughout the car, alongside tow trucks that needed organising. It was already stressful. Trying to get hold of someone, anyone, about the insurance only made it worse.

We couldn’t find details about their insurance policy details online, and their login didn’t show anything useful. There was no clear next step, just waiting and uncertainty at a time when answers mattered.

All I could think was how different this would have been if they’d been with initio. A claim could have been lodged immediately online; the system would have provided clear instructions on what to do next and what to expect from your insurance provider. All policy details and cover information would have been sitting there in one place.

Simple, transparent, and there when it counts

That’s one of the things we’re most proud of. With initio, your insurance policy, documentation, and details are available online through your dashboard. No digging through emails. No wondering what you’re covered for. No guessing who to call.

Insurance is stressful enough without added complexity.

Being a digital insurance provider isn’t about doing less for our customers. It’s about doing better. Using technology to remove the noise, so when you really need us, we’re available, responsive, and human.

Because at the end of the day, we’re not just digital. We’re people first.

You might also be interested in:

Written by Megan Fisher, Head of Marketing at initio.

Megan has been with initio since 2022 and has over 20 years’ experience in marketing and product strategy. She works closely with initio’s claims and customer experience teams, giving her a first-hand view of how insurance works when customers need it most.