Understanding insurance for coastal properties

Living near the coast has a lot going for it. Sea views, beach access and a relaxed lifestyle are a big drawcard. But coastal properties can also come with additional risks, which means house insurance is often one of the first questions buyers ask.

If you are buying, owning, or thinking about selling a coastal property, it helps to understand how insurers assess risk, and how to navigate coastal risks with confidence.

Key things you’ll learn in this article:

- Whether coastal properties can be insured, and what insurers assess

- How flooding, erosion and subsidence affect insurance decisions

- Why some coastal homes require a customised solution

- What long-term insurability could mean for owners and buyers

- How to check if your property can be insured

Can I insure a coastal property right now?

In many cases, yes. Being close to the coast does not automatically make a property uninsurable.

Initio can insure a wide range of coastal properties, provided the risk profile meets our underwriting criteria at the time cover is considered. When assessing a coastal home, we look at factors such as:

- proximity to the coastline or waterways

- flood history or flood modelling for the area

- exposure to coastal erosion

- land stability, subsidence and coastal erosion risk

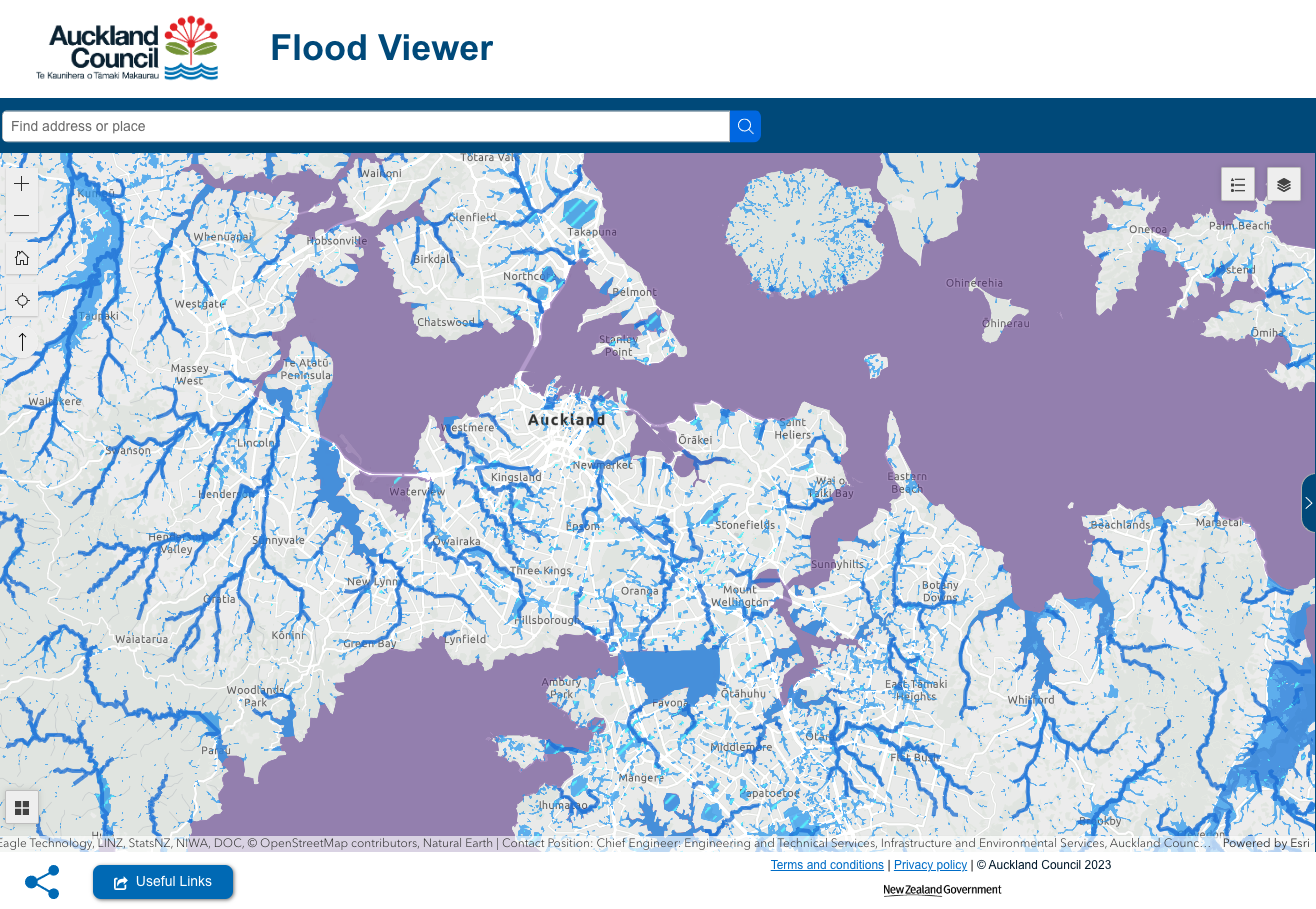

- local hazard maps and council information

- previous claims or known damage

You can obtain a quote online using the information available at the time and the details you disclose as part of the application. Depending on those details, the application may be able to be confirmed straight away, or it may be referred to our underwriting team for review before cover is confirmed.

In some situations, we may not be able to offer cover through our online model. This does not necessarily mean the property is uninsurable, but rather that it may require a more customised insurance approach that sits outside what initio is able to provide.

Does initio have concerns about erosion, flooding or subsidence?

These are some of the key risks we assess for coastal properties.

Flooding

Flooding is one of the most common risks for coastal homes, particularly where properties are close to estuaries, rivers, low-lying land, or stormwater outlets. Heavy rainfall, storm surge and rising sea levels can all increase flood risk over time. In some coastal areas, king tides can also contribute to higher water levels, particularly when they coincide with storm events.

Learn more about flood risks and zones, and natural hazard cover.

Coastal erosion

Coastal erosion can occur gradually over many years, or suddenly during severe weather events. Properties built close to cliffs, dunes, or unstable shorelines can be more exposed to this risk.

Subsidence, land movement and coastal erosion

Coastal land can sometimes be affected by subsidence, erosion, or other forms of land movement, particularly where soils are soft, saturated, or influenced by changing groundwater or coastal conditions.

Subsidence and coastal erosion themselves are not covered under most house insurance policies. However, evidence of either can increase the likelihood of other insured events. For example, land that has experienced erosion or subsidence may be more susceptible to landslip or slope failure during large weather events, which can be covered under a house policy.

For this reason, insurers consider subsidence, land movement and coastal erosion together when assessing the overall risk profile of a property.

These factors do not automatically make a property uninsurable, but they do influence how insurers assess cover, pricing and long-term sustainability.

Why some coastal properties need a customised insurance solution

Initio is an online insurance provider. Our policies, pricing and underwriting are designed to work efficiently for a wide range of homes without the need for one-off or bespoke policy structures.

For most properties, this allows us to offer fast quotes, clear cover and easy ongoing management. However, some coastal properties have risk profiles that sit outside what can be supported through a standard online insurance model.

This can occur where a property has one or more higher or more complex risks, such as:

- significant exposure to coastal erosion

- repeated or severe flooding history

- known land instability or subsidence

- reliance on ongoing protective or mitigation works

- access challenges that affect emergency response or repairs

Where a property has these characteristics, it may require a customised insurance solution tailored specifically to its risks.

Unfortunately, as an online insurance provider, initio is unable to offer customised or bespoke insurance solutions. This does not reflect the quality or care of the property itself, but rather the way certain risks need to be assessed and managed.

Our focus is on being upfront, consistent and clear, so customers can understand their options and navigate coastal risks with clarity.

See what’s included by reading our policy wordings.

What does this mean for long-term insurability?

Insurance decisions are based on the best information available at the time, including hazard modelling, claims experience and climate data. As this information evolves, insurance settings can evolve too.

For many coastal properties, any changes tend to happen gradually rather than all at once. Over time, this might mean things like:

- premiums adjusting as risk profiles change

- excesses being updated for certain types of events

- small changes to policy terms

- fewer insurers offering cover in higher-risk areas

If a property already needs a more customised insurance approach today, it can be a sign that the risk profile is more complex than average. This does not mean insurance will suddenly become unavailable, but it is something buyers and owners may want to keep in mind as part of longer-term planning.

Learn more about complex insurance quotes

Could this affect resale value?

For some buyers, insurance is becoming another factor they consider alongside location, price and future maintenance.

If a property is more expensive or complex to insure, that may influence how some buyers assess value. That said, many coastal homes remain highly desirable, and insurance is just one piece of the overall picture.

Thinking ahead about insurability, maintenance and risk mitigation can help support both ongoing cover and future resale appeal. If you are purchasing at auction or under conditional agreement, our guide on obtaining a letter of intent explains how to confirm cover during the buying process.

Things to consider when buying or owning coastal property

If you are considering a coastal home, it can help to:

- check council hazard maps and LIM reports

- understand past flooding, erosion or land movement in the area

- ask about previous insurance claims

- consider how close the home is to the shoreline or waterways

- think about any risk mitigation already in place

These steps can help you better understand both current and future insurance implications.

How to check if your property can be insured

The best place to start is with a quote, or by obtaining a letter of intent.

If it is referred for review, our team will assess the details provided and explain the outcome, so you can decide on your next steps with clarity. When requesting a letter of intent, it is important to disclose all relevant information you are aware of as part of your due diligence, such as flood zoning, coastal erosion exposure, land stability concerns or council hazard classifications.

Insurance does not have to be hard, even when you are navigating coastal risks.

You might also be interested in:

- Five tips to insuring in a flood zone

- There’s been a natural disaster, what happens next?

- Am I covered for natural disasters?

- Confirm you can obtain insurance before you make an offer

- How do I make an insurance claim?

- One insurer, one headache

External resources

Written by Toby Pudney – initio’s support team lead.

Toby has been with initio since 2023 with 6 years of experience in the insurance industry. Credentials: ANZIIF New Zealand Compliance for Advisers (General Insurance Broking)