What if my quote isn’t straightforward?

Most of the time, getting a quote with initio is fast and simple. But every now and then, something pops up that needs a closer look – whether it’s a map that doesn’t match your house, a question about flood zones, or a message saying your quote needs review. This guide covers the common situations that can make things a bit less straightforward, and what to do next if that happens.

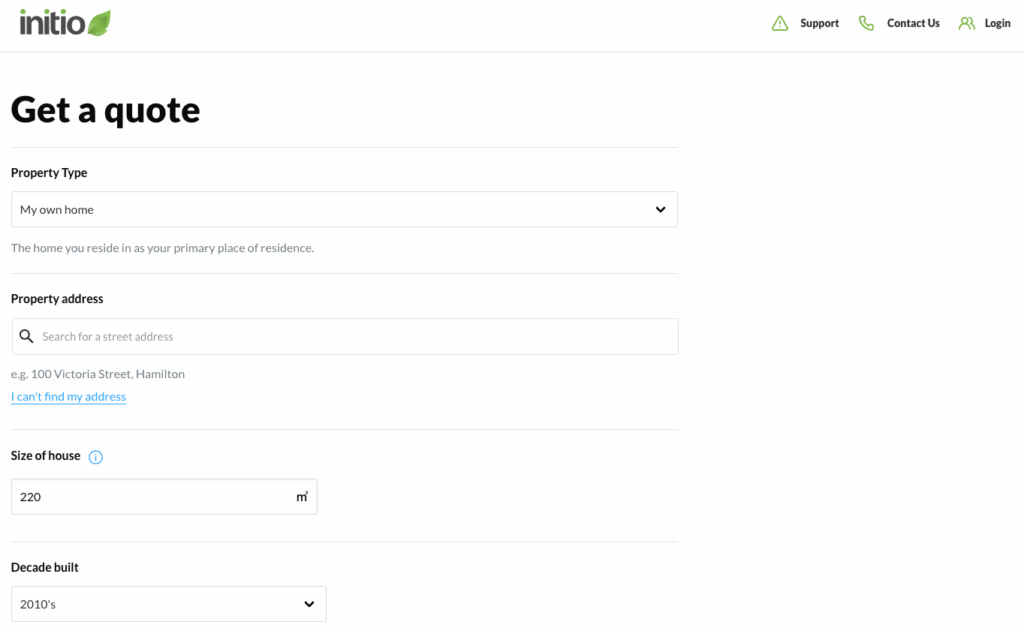

Can’t find your address in the quote tool?

If your address doesn’t come up with the details you have entered, please use the blue option below the address box that then comes up showing as “I can’t find my address”. Clicking on that option will let you enter both the house number and street manually.

If your property is a new build in a particularly new street, potentially our database may not be able to locate the street, if so, please give our team a call to obtain a quote.

Your website says my home is in an RMS flood zone. I called the council and they said I’m not?

It’s quite common for there to be differences between the flood risk assessments provided by initio (using RMS data) and those from your local council. RMS (Risk Management Solutions) uses advanced modelling techniques, recent data, and a national standardised approach, while councils may focus on specific local concerns and use different methodologies or older data. This means that RMS might identify risks not yet reflected in council maps, or vice versa. If you have concerns about these discrepancies, we encourage you to get in touch with our team for further clarification. You can reach the initio team through our contact page — it’s the best way to connect with the right person quickly.

I don’t need flood cover, I live on a hill

Initio’s home insurance policies automatically include flood cover as part of the standard protection, and it cannot be removed or excluded, even if you live on a hill or believe your property is not at risk. This is because the policy is designed to provide comprehensive cover for all insured events, including those that may be unexpected.

Can you do risk-based pricing for my property specifically?

Initio uses risk-based pricing for its property insurance policies, which means your premium is calculated based on specific factors related to your property, such as location, construction type, and exposure to risks like flood or earthquake. However, the risk assessment is determined by initio’s underwriting and data models, and individual requests for manual risk adjustments or exclusions are not available. If you believe there is a significant error in how your property’s risk has been assessed, you can contact the initio team to discuss your situation further.

Why does the water supply matter?

The water supply matters because it affects the risk of significant damage in the event of a fire. Properties that are closer to a fire station and have better access to water are less likely to suffer extensive fire damage, which can result in lower insurance premiums. For example, a house next to a fire station will generally have a lower premium than one that is far from town and relies solely on rainwater tanks. This is one of several factors used by initio to calculate your house insurance premium. Learn more about how premiums are calculated

The map image above the quote is not my house

The map image shown above your quote on the initio website is generated automatically based on the address information you provide, and sometimes it may not display the exact property, especially for new builds or properties in recently developed areas. This image is for reference only and does not affect your insurance cover or the details of your policy. If you have concerns about your address or need to ensure your property is correctly identified, please get in touch with the initio team through our contact page

Your website gave me a quote. Now it says you need to review it before you can provide cover. What do I do now?

If your quote shows that a review is required, it means our team needs to check some details about your property or situation before we can offer terms. This can happen for a few reasons, such as unique property features, location, or other risk factors.

To proceed:

-

From your quote, select either the annual or monthly option

-

Complete the online application form and submit it

Once submitted, a member of the initio team will review your application and contact you directly. There’s no obligation to purchase once the review is complete.

If you’d like to follow up or have any questions while you wait, get in touch with the Initio team through our contact page .

If you’re insuring more than one property with initio, please wait until the first application has been reviewed and the policy purchased before submitting the next. Once that’s done, you’ll be able to submit your next property directly from your new initio account, which keeps your portfolio together in one place.

Start a new quote or check your address

If you’re unsure about the details in your original quote, or just want to double-check your address and start fresh, it’s easy to get a new quote online. Our quote tool is quick, and you’ll be guided through the process in just a few steps.

Related articles

- How to buy your first policy

- How to navigate your initio dashboard

- How to claim with initio

- How to get a quote with initio

- Insuring old homes