Initio’s house insurance covers sudden and accidental damage to your home, including fire, flood, storm, and natural disasters. It also includes cover for legal liability if someone is injured or their property is damaged because of your home.

The policy comes with a range of automatic benefits like temporary accommodation, hidden gradual damage, keys and locks, blocked pipe clearance, and even support for sustainable upgrades if you’re rebuilding. Like all insurance, some exclusions apply – such as wear and tear, long-term vacancy, and illegal activity unless specific conditions are met. Read the full policy wordings

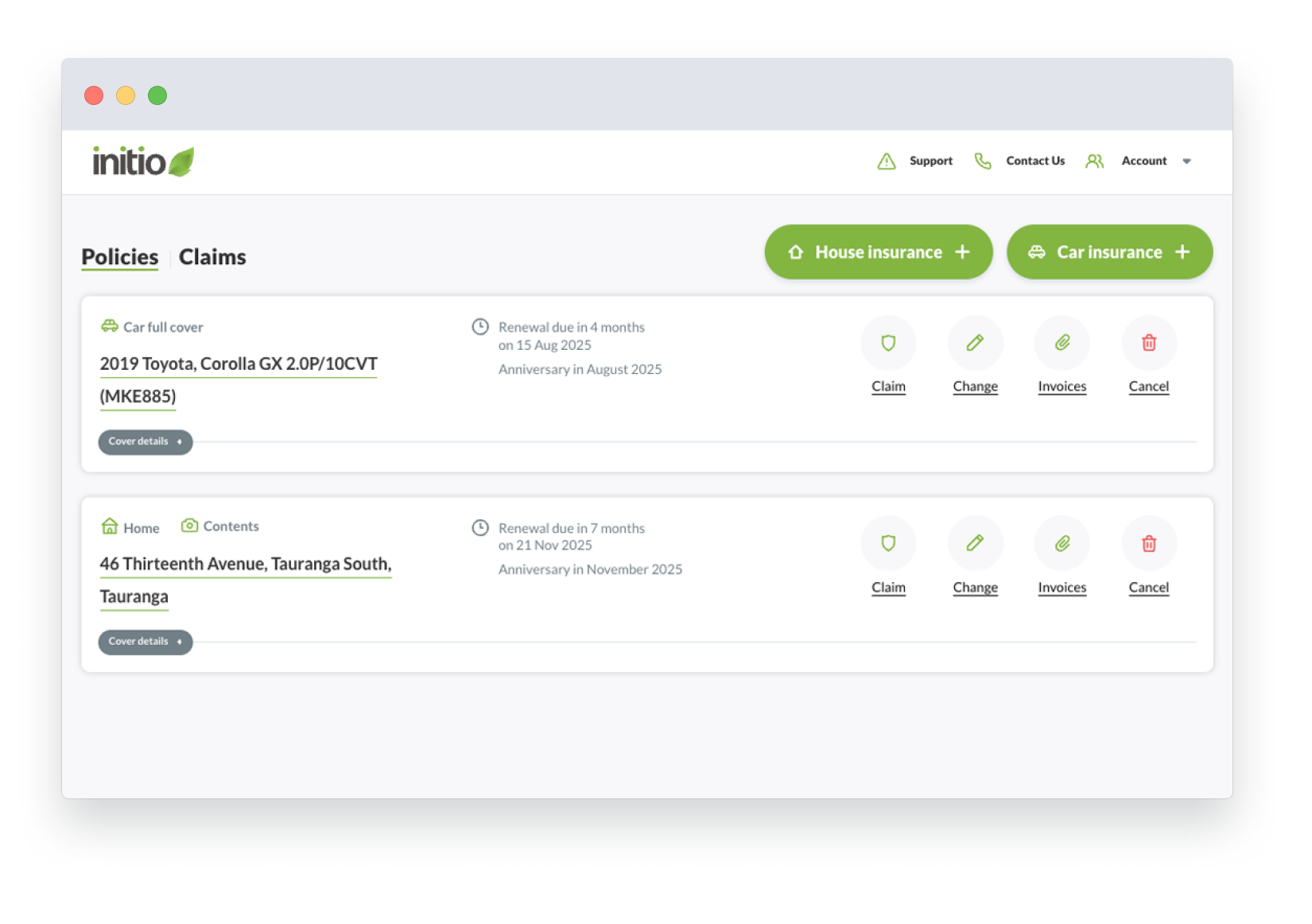

In most cases, you can get covered instantly. The entire process is online — just choose your policy, get a quote, and insure your home straight from the initio website. Your policy confirmation will land in your inbox within minutes, and you’ll get access to your own insurance dashboard to manage everything easily.

For most standard homes, cover is available straight away. If your property has unique features or falls outside standard underwriting criteria, the system will let you know if a manual review is needed. You can still submit your application, and our team will get back to you quickly.

Learn how our technology makes getting house insurance quotes quick and easy.

It depends on what best means to you – but if you’re after a simple, flexible, and smart option, initio could be just what you need.

We’re built for property owners who want to get covered quickly, manage everything online, and actually understand what they’re paying for. Our house, contents, and landlord insurance is packed with useful benefits – no surprises, just clear cover.

To help you decide, we’ve put together a side-by-side comparison of initio and other insurance providers. It shows exactly what’s included, so you can see how we stack up.

House insurance isn’t just a box to tick – it protects your home (and your wallet) when the unexpected happens, like fire, flood, or sudden damage. Without cover, you’d be left paying the full repair or rebuild costs yourself, which can run into the hundreds of thousands.

Learn why insurance matters, how to keep costs down, and why it’s one of the smartest ways to protect your biggest asset. Read the full guide here

Yes, initio house insurance includes cover for natural disasters such as earthquakes, floods, and landslides, up to the sum insured on your policy.

From 1 July 2024, the Natural Hazards Insurance Act 2023 applies. Under this, the Natural Hazards Commission (NHC) covers the first $345,000 (including GST) of qualifying natural disaster damage. Initio then provides top-up cover for any additional repair or rebuild costs, up to your selected sum insured.

Flood damage to your home is also automatically covered by initio, with no contribution from the NHC required for the home itself.

For more details, you can visit the Initio page on what we cover for natural disaster cover and our summary of the NHC’s cover here.

No, the sum insured is not the same as what you paid to buy your house.

The sum insured should reflect the cost to fully rebuild your house to its current size and standard at today’s building costs, not its market value or purchase price. This amount should also include the cost of rebuilding other structures like fences and pools, as well as demolition costs and a buffer for inflation.

Choosing the right sum insured is important to avoid being underinsured. Learn more about how to calculate sum insured

It depends on things like your address, the rebuild value of your home, and what level of cover you choose. But with initio, you don’t have to guess.

You can get an instant price using our quick quote tool – no personal details needed, and no waiting around. Just enter your address and a few basic details about the home, and we’ll show you the cost upfront.

It’s fast, easy, and designed so you can compare and tweak your cover before you buy.

If you need just a little more information before making your purchase, we have plenty of helpful support articles at your fingertips. We’ve also written the five key fundamentals of house insurance, covering everything you need to consider when choosing a new policy.

Initio doesn’t offer contents-only policies. Our cover is built around insuring the house itself, and contents cover is an optional add-on to that.

Because most contents claims happen at the same time as house claims (like a fire, flood, or burglary), it works best when both are under the same policy. It also keeps things simple—one insurer, one claim, one process.

If you’re renting and need contents-only insurance, you’ll need to look at another provider. Initio is designed for homeowners and landlords, so our focus is on houses first.

If your house is already insured with initio, you can easily see the price and add the contents option using the change button on your initio dashboard.

If you’re looking to insure your home and/or contents with initio, use our instant quote for your property address and include or exclude the contents option as required.

If you’re travelling overseas, we recommend taking out travel insurance with a specialist provider. Our contents policy has a limited benefit for items you take with you when you are in transit to and from, and travelling within, Australia or the South Pacific Islands. This cover applies for trips of up to 3 weeks, with a maximum benefit of $5,000.

Depending upon your circumstances. If you are looking for insurance and may potentially sell your home later in the year, you can cancel the policy when the home settles and a refund will be provided for any unused portion.

If you are buying to renovate and re-sell quickly with some cosmetic changes, look into our specialised ‘Flip’ cover to see if it suits your purposes.

Get in touch with our team to discuss other short term cover circumstances to see if we can assist.